Futility of capital controls?

Business Standard, 19 December 2007

India has tried to use capital controls, so as to go closer to the erstwhile policy framework of a pegged exchange rate with monetary policy autonomy. How effective has this been? It is always hard to judge how effective capital controls have been. However, provisional evidence suggests that they have not been very effective.

Judging the impact of capital controls is difficult for three reasons:

-

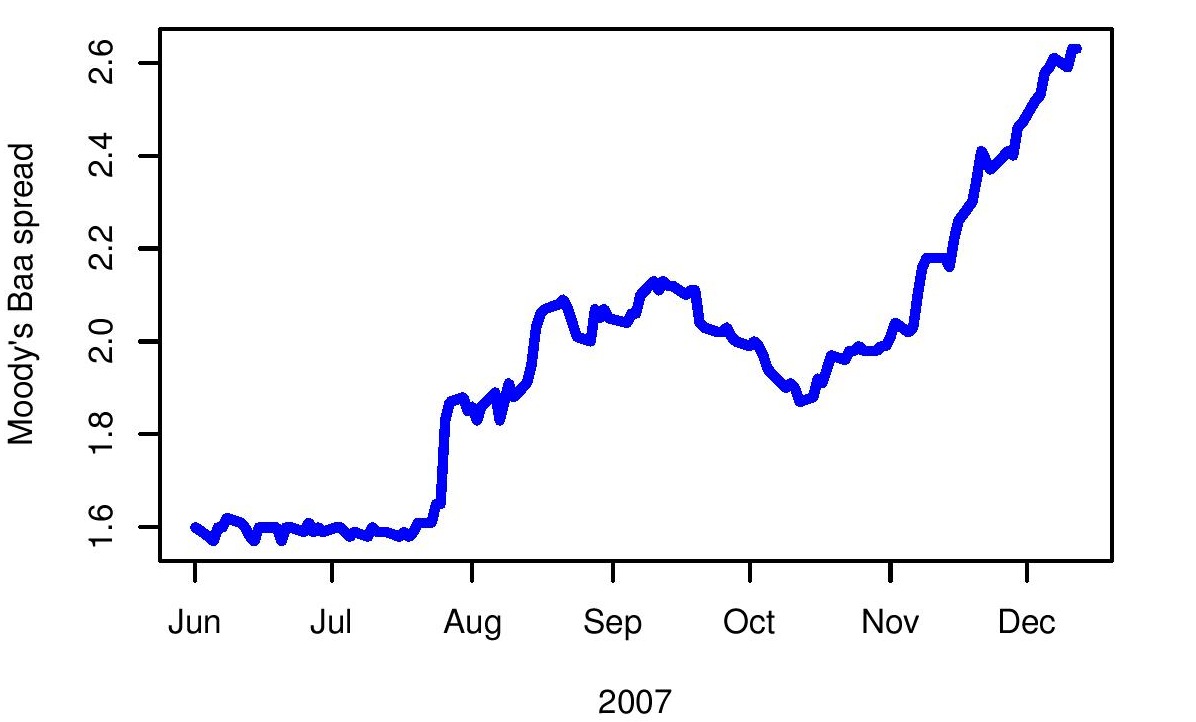

Macroeconomic conditions, and the deeper determinants of capital flows themselves, change fairly rapidly and are generally not comparable between the period before and after capital controls were introduced. In recent weeks, measures of global risk aversion (the US risk premium on corporate bonds, and the expected volatility of the S&P 500 index) have risen sharply, which should normally induce lowered capital flows into India.

Macroeconomic conditions, and the deeper determinants of capital flows themselves, change fairly rapidly and are generally not comparable between the period before and after capital controls were introduced. In recent weeks, measures of global risk aversion (the US risk premium on corporate bonds, and the expected volatility of the S&P 500 index) have risen sharply, which should normally induce lowered capital flows into India.

- Further, when looking at any one component of capital flows which was targeted, it generally looks like the controls are making a difference. However, the deeper story is that when one avenue is barricaded, capital finds other avenues. To be really effective, broad-scale capital controls - comparable to India's shutting out of the world after independence - are required. As a consequence, post-mortems should not focus on one element at a time. To judge the effectiveness of capital controls, broader measures need to be used, such as the extent to which monetary policy independence was obtained, or the extent to which the desired exchange rate distortions were achieved.

- Finally, capital controls hurt the interests of a broad spectrum of households and firms, which induces political pressure to avoid controls or carve out special exemptions. The capital controls envisaged by proponents of autarky are inevitably attenuated by the political system. When a country is democratic and desires organisation on market principles, it is hard to bring in the sweeping capital controls and correspondingly sweeping financial repression that is required in order to matter.

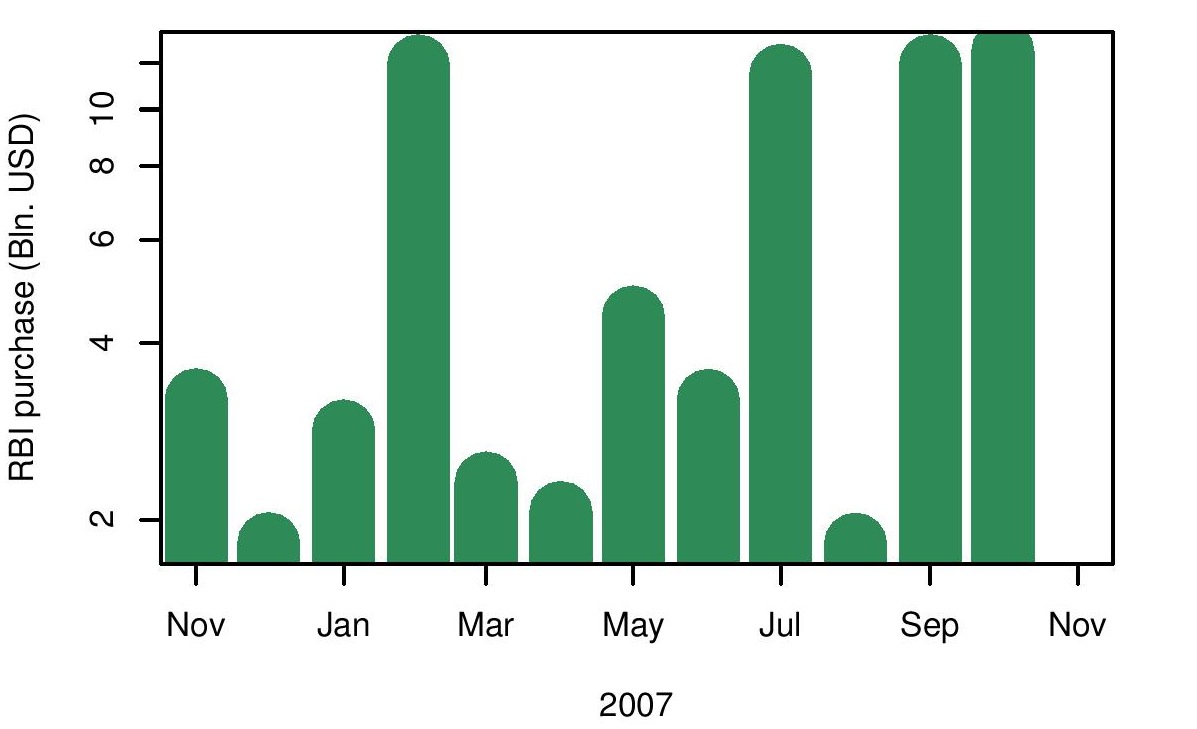

The closest there is to a bottom line, in thinking about the impact of controls, is the extent of pressure on implementation of the pegged exchange rate. This is best measured by watching RBI's trading on the currency market. For the last one year, RBI's purchases have averaged $6 billion a month. This run rate leads to $50 billion a year of purchases, which is unacceptable in terms of their monetary consequences. Upholding the pegged exchange rate critically requires getting the run rate of RBI's currency trading to below $6 billion a month.

The closest there is to a bottom line, in thinking about the impact of controls, is the extent of pressure on implementation of the pegged exchange rate. This is best measured by watching RBI's trading on the currency market. For the last one year, RBI's purchases have averaged $6 billion a month. This run rate leads to $50 billion a year of purchases, which is unacceptable in terms of their monetary consequences. Upholding the pegged exchange rate critically requires getting the run rate of RBI's currency trading to below $6 billion a month.

The latest data available show massive trading by RBI of $12 billion and $12.5 billion for September and October. There is, as yet, no hint of getting below $6 billion a month. These large values suggest that the capital controls introduced until September and October have not had a sharp impact on the size of market manipulation required in order to distort the exchange rate as desired by the government.

There is anecdotal evidence that RBI has thrown up bureaucratic hurdles and artificial delays in giving out permissions for ECB, thus having even more barriers against ECB than the official policy position suggests. One element of this is a sharp drop in the number of companies who are able to do ECB. In March, this was 109 companies. In October, this has dropped to 30 companies. This is consistent with the international evidence on the microeconomic impact of capital controls, where it has been found that big companies are able to invest greater resources on getting past a system of capital controls. The incidence of the controls falls disproportionately on smaller companies.

If RBI is indeed deviating from the official policy position, this is deplorable at two levels. At one level, deviating from the official policy position raises questions about the rule of law in India. Further, such bureacratic tactics - which big firms are able to overcome but small firms are not - elevate the cost of capital for small firms, which is not a desirable outcome in terms of economic thinking.

Turning to FII flows, recent policy initiatives have sought to curb participatory notes. From the microeconomic perspective, these initiatives increase inefficiency and cost. From a macroeconomic perspective, however, they do not achieve a significant change in capital flows. India continues to have de facto convertibility on the equity market, wIth thousands of foreign investors directly participating in the domestic market. SEBI's efforts at easing the frictions faced by FIIs in registration help ensure a continued expansion of the universe of investors for whom India has convertibility.

The policy discussion tends to focus on ECB and PNs, since these are the places where RBI tried to bring in capital controls. However, the really important responses of economic agents will be found in other places. The most important area that deserves emphasis is the large and growing current account. Most large Indian firms are turning themselves into multinationals. An offshore subsidiary can now borrow, transfer price the capital into the country, followed by a stream of repayments effected (once again) by transfer pricing. The capital flows that we seek to block will show up as flows on the current account.

The policy discussion tends to focus on ECB and PNs, since these are the places where RBI tried to bring in capital controls. However, the really important responses of economic agents will be found in other places. The most important area that deserves emphasis is the large and growing current account. Most large Indian firms are turning themselves into multinationals. An offshore subsidiary can now borrow, transfer price the capital into the country, followed by a stream of repayments effected (once again) by transfer pricing. The capital flows that we seek to block will show up as flows on the current account.

This ground reality - that capital controls are increasingly ineffective in a modern economy - is not new to India. India is actually one of the last countries that has made the strides into modernity to a point where these difficulties are now visible. It is not an accident that roughly two-thirds of the countries of the world have a more open system of de jure capital controls when compared with India. Year after year, while India is trapped in obsolete economic thinking, we see more countries decontrol more parts of their capital account [see slides 24-30 here]. By and large, this is not done owing to the broad principle of not interfering with personal freedom. It is done out of the practical understanding by practical men that capital controls are unworkable in a mature market economy.

The outstanding macroeconomic fact about India consists of one change: In 1997, gross flows on the current and capital account (put together) were 50% of GDP. In one decade, this number jumped to 110% of GDP. A massive structural change of the economy has been compressed into these 10 years. For a comparison, the rise from 1977 to 1987 was a mere 1.9 percentage points. This big macroeconomic fact requires a corresponding shift in macroeconomic policy. The recipes which worked in the 1980s and the early 1990s are no longer optimal for India.

Back up to Ajay Shah's 2007 media page

Back up to Ajay Shah's home page