Tracking the downturn

Financial Express, 15 December 2008

In tracking the global downturn, it is particularly important to not look at year-on-year changes. In the change over one year of (say) exports, we are seeing the average of the change over each of the last 12 months. But the dramatic developments of the global economic downturn accelerated sharply in late 2008, and we need to look at the individual months of September and October. Averaging over a year obscures the information of recent months.

The right strategy is hence to look at month on month changes. This requires seasonal adjustment of the raw data.

Non-food credit

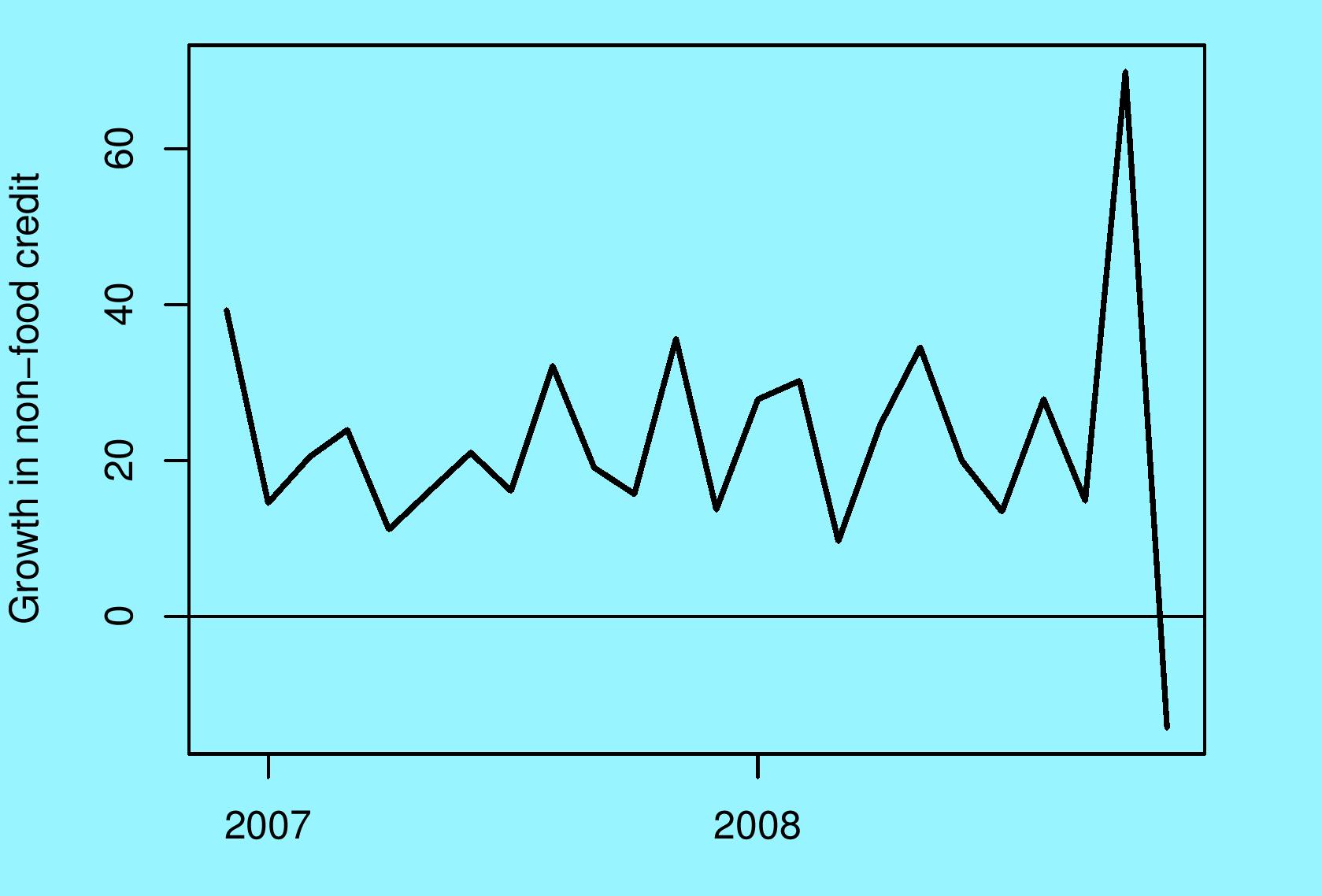

Non-food credit of the banking system is one important indicator of how the economy is faring. The year on year growth, which is widely watched, bounced around dramatically from 24.8% in September to 30.6% in October to 25.5% in November. The month-on-month changes, based on seasonally adjusted data, tell a more interesting story.

The annualised growth of non-food credit (after seasonal adjustment) rose dramatically to 69.88% in October. This may reflect a bigger effort by firms to use money from banks given the liquidity squeeze and the shortage of dollar financing overseas. In November, the growth of non-food credit dropped to -14.3% on an annualised basis. It is too early to tell whether this reflects a dropoff in economic activity or a mean reversion after the sharp growth of October. As the graph shows, both these values (+69.88% and -14.3%) are unprecedented values when compared with the experience of the recent two years. While there is a global financial crisis, credit by Indian banks has not experienced a disclocation.

The annualised growth of non-food credit (after seasonal adjustment) rose dramatically to 69.88% in October. This may reflect a bigger effort by firms to use money from banks given the liquidity squeeze and the shortage of dollar financing overseas. In November, the growth of non-food credit dropped to -14.3% on an annualised basis. It is too early to tell whether this reflects a dropoff in economic activity or a mean reversion after the sharp growth of October. As the graph shows, both these values (+69.88% and -14.3%) are unprecedented values when compared with the experience of the recent two years. While there is a global financial crisis, credit by Indian banks has not experienced a disclocation.

Looking forward, two things will change. Firms will demand more credit and banks will become more wary about credit risk. By mid-2009, banks will start showing bigger NPAs which will adversely affect their ability to take risk. Hence, by mid-2009 the picture on bank credit could be significantly altered. But as of yet, while there is substantial volatility, there is no dislocation.

Imports and exports

Two other important indicators of what is happening in the economy are merchandise imports and exports. Here, it is important to exclude the imports and exports of crude oil and petroleum products which have swung around dramatically owing to fluctuations in the price of oil. The monthly imports of crude oil, which peaked at $12.4 billion in July, dropped to $8 billion in October. This decline is smaller than the drop in crude oil prices, and may be attributed to import through long-term contracts which had locked in on prices at earlier dates. In coming months, a further decline is likely.

Hence, we focus on non-oil imports and non-oil exports. Here, the month-on-month changes are very noisy and it is hence best to look at three-month moving averages. These are still faster at catching changes as compared with the year-on-year changes, which represent a 12 month moving average. This data runs till October only, unlike the data for non-food credit which runs till November.

Hence, we focus on non-oil imports and non-oil exports. Here, the month-on-month changes are very noisy and it is hence best to look at three-month moving averages. These are still faster at catching changes as compared with the year-on-year changes, which represent a 12 month moving average. This data runs till October only, unlike the data for non-food credit which runs till November.

In the case of imports, there is a deceleration in the annualised growth rate to -31% by October. This reflects sharp month-on-month declines in September and October. At the same time, the values seen in the graph are not outlandish when compared with the two-year experience. By and large, the events on imports are not sharply out of line with the historical experience of the recent two years.

In the case of imports, there is a deceleration in the annualised growth rate to -31% by October. This reflects sharp month-on-month declines in September and October. At the same time, the values seen in the graph are not outlandish when compared with the two-year experience. By and large, the events on imports are not sharply out of line with the historical experience of the recent two years.

The biggest change owing to the global downturn has been seen in exports. The three-month moving average is showing values of -83% and -99% (on an annualised basis) in September and October respectively. These point to a significant dislocation in imports by the world from India in September and October. The interpretation of these values is as follows: If exports continue to drop as they did from August to October, then within a year, exports will drop to 0.

Looking forward on international trade

Such a dire outcome is, of course, not going to materialise. In September and October, the world was startled at what had happened and many firms froze their decision making. Trade financing ran into difficulties owing to the problems of the global financial system. Commodity-linked transactions got into trouble because of the sharp fluctuations in commodity prices between the date an order was placed and the date that the shipment was delivered.

By and large, these extreme difficulties are behind us. Trade financing is limping back to life. Commodity price volatility has subsided and will drop further. Firms who were startled at the events and frozen in their tracks are gradually getting back to business. The RBI has been sensible in giving market forces a significant say in fluctuations of the exchange rate, which has given Indian exports the benefit of a depreciation against the dollar and the yen. Calendar 2009 will be a bad year, but the changes that we will now see will not be as bad as those experienced from August to October, where the three-month moving average of month-on-month annualised seasonally adjusted change in non-petroleum exports was -99%.

In terms of the outlook for the trade deficit, several factors are at work. The drop in crude oil prices alone reduces India's expenses by $5 billion a month or more. In a slowing economy, demand for imports will drop. There is a lag between weak exports and reduced imports of intermediates; hence, India's merchandise imports are likely to slow further as compared with the values shown here. Finally, Indian exports benefit from currency depreciation while demand for foreign goods will drop for the same reason as consumers switch from costly foreign goods to local substitutes. These factors will yield a relatively benign situation on the current account.

The really important component of the current account, for which there is no monthly data, is services exports. As of today, roughly nothing is known about how Indian exports of IT and IT-enabled services are holding up in the downturn. Since services exports are of the same order of magnitude, what happens there will have a major impact on the current account.

Back up to Ajay Shah's 2008 media page

Back up to Ajay Shah's home page