Why has India coped rather well with the decline in capital inflows?

Financial Express, 23 February 2009

A sharp decline in capital flows

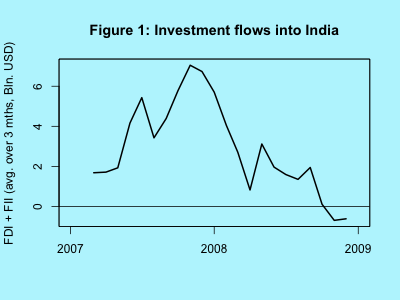

India has experienced a sharp decline in capital inflows. Figure 1 shows the sum of FDI and portfolio flows, measured in billion dollars. The value shown for each month is the average over the latest three months.

India has experienced a sharp decline in capital inflows. Figure 1 shows the sum of FDI and portfolio flows, measured in billion dollars. The value shown for each month is the average over the latest three months.

From large values of above $6 billion a month, this number turned slightly negative in November and December 2008. Thus, India has experienced a decline in equity flows of roughly $6 billion a month. There is more to capital inflows than just FII and FDI flows; there is also debt capital. These flows have also suffered. Another dimension which affects the currency market is export revenues, and exports growth has also suffered.

A surprising calm on the currency market

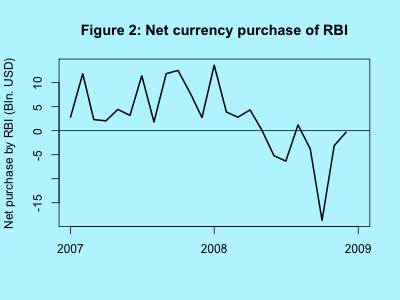

Under normal circumstances, this shift of $6 billion a month, or around $300 million a day, would have generated significant effects on the currency market. Figure 2 shows RBI's transactions on the currency market. There was one month when RBI did a lot to defend the rupee: in October, RBI sold $19 billion. But after that, the rupee has held up fairly well without artificial props. In November, RBI sold $3.1 billion and in December, RBI sold only $0.3 billion.

Under normal circumstances, this shift of $6 billion a month, or around $300 million a day, would have generated significant effects on the currency market. Figure 2 shows RBI's transactions on the currency market. There was one month when RBI did a lot to defend the rupee: in October, RBI sold $19 billion. But after that, the rupee has held up fairly well without artificial props. In November, RBI sold $3.1 billion and in December, RBI sold only $0.3 billion.

This raises a question: at a time when equity capital inflows have taken a hit of $6 billion a month compared with the peak, where debt flows have done badly, and exports have done badly, how is it that the rupee has found stability without much interference from RBI?

The culprit: a crash in the price of crude oil

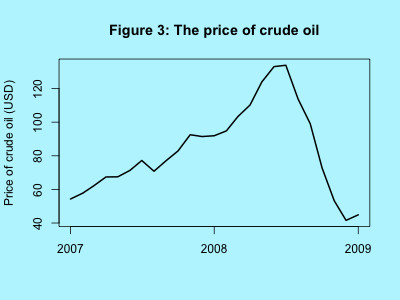

A key element of the story lies in the price of crude oil and other commodities. Figure 3 shows the price of Brent crude oil. This has dropped dramatically from a peak of $134 a barrel in July 2008 to $45 a barrel in January 2009. India imports roughly 2 million barrels a day of crude oil. The decline in the price of crude oil of $89 per barrel gives a benefit of $5.5 billion a month or roughly $65 billion a year.

A key element of the story lies in the price of crude oil and other commodities. Figure 3 shows the price of Brent crude oil. This has dropped dramatically from a peak of $134 a barrel in July 2008 to $45 a barrel in January 2009. India imports roughly 2 million barrels a day of crude oil. The decline in the price of crude oil of $89 per barrel gives a benefit of $5.5 billion a month or roughly $65 billion a year.

One complication in this picture is the hedging using derivatives markets done by Indian importers of crude oil such as Reliance. In an environment where the danger of higher crude oil prices was a real one, firms had an incentive to buy crude oil futures on exchanges such as NYMEX, so as to lock in the price for future imports of crude oil. In the short run, these positions have experienced massive losses, which has counterbalanced the reduction in the price of importing on the spot market. However, it is likely that these issues are now increasingly out of the way, and the full benefit of cheaper crude oil is now accruing to India.

Benign picture on cost of imports

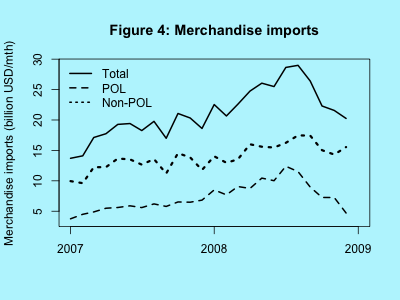

This implies that India now pays less for imports. Figure 4 shows India's merchandise imports, expressed in billion dollars per month. Three series are shown: total imports, imports of crude oil and products, and other imports. This shows a dramatic decline in imports of crude oil and products, from a peak of $12.4 billion in July 2008 to the latest value of $4.7 billion in December 2008. There was a saving of $7.7 billion on this count alone. This number needs to be adjusted by the fact that India also exports petroleum products. However, the basic point is clear: the reduction in crude oil prices has given India a substantial respite, one that roughly counter-balances the decline in equity flows.

This implies that India now pays less for imports. Figure 4 shows India's merchandise imports, expressed in billion dollars per month. Three series are shown: total imports, imports of crude oil and products, and other imports. This shows a dramatic decline in imports of crude oil and products, from a peak of $12.4 billion in July 2008 to the latest value of $4.7 billion in December 2008. There was a saving of $7.7 billion on this count alone. This number needs to be adjusted by the fact that India also exports petroleum products. However, the basic point is clear: the reduction in crude oil prices has given India a substantial respite, one that roughly counter-balances the decline in equity flows.

The benefits to India of this changed international environment extend beyond crude oil. India is largely a commodity importer or a commodity re-processor. Numerous commodity prices have dropped, including energy, metals, agriculturals, etc. Indian imports of capital goods, machinery, telecom equipment, computer equipment have all benefited from the global softness in prices. These changes have helped reduce the import bill.

A historic opportunity to build infrastructure

These dramatic changes in prices have many implications. As an example, consider infrastructure. India is now presented with a historic opportunity for building roads, railways, ports, airports, urban mass transport, pipelines, and telecom infrastructure, given the unprecedentedly lower prices of capital goods. Given that India is a natural long-term importer of capital goods, the recent events act in India's favour. As an example, the rollout of 3G telephony in India will be unprecedentely cheap - by world standards - because of the reduced prices of 3G equipment in India in this gloomy economic environment. Similarly, international engineering companies, who are starved of work, will now come forth with unimaginably low bids to build urban metro lines in Delhi and elsewhere. Policy makers and the private sector must seize this opportunity to build infrastructure on a big scale at these bargain basement prices.

Back up to Ajay Shah's 2009 media page

Back up to Ajay Shah's home page