What could go wrong if petroleum product prices are decontrolled?

Financial Express, 8 February 2010

The report of the group chaired by Kirit Parikh, on ending the system of administered pricing for petroleum products, is an outstanding one and well worth reading. What could go wrong when the prices of petroleum products are decontrolled? Three kinds of arguments can be made:

- Some believe that it is important to subsidise the fuel purchases of poor people, either because it makes economic sense or because it makes political sense.

- It could be argued that world oil prices are subject to short-term shocks. It could then be claimed that government can help by absorbing short-term fluctuations and giving the private sector a more stable environment.

- It could be argued that floating rates for petroleum products will generate inflation or inflation volatility.

1 Fuel for poor people

The first argument is easy to dispose of. The CMIE household survey data shows that only 14.49% of consumption of cooking fuel is undertaken by the 21.2% of the population that is classified as `poor' by CMIE. It is inefficient to subsidise kerosene (and other petroleum products) for all, in an attempt to only get cheap kerosene to this fifth of the population.

If a Prime Minister wants to subsidise fuel purchases of poor people, the direct way to do this is to deliver cash subsidies to them (e.g. as is being done using NREG) or to give poor people vouchers entitling them to purchase fuel at a discounted price. The retail outlet which sells fuel at this reduced price would carry these vouchers to the government and get reimbursed.

There are implementation issues in ensuring that vouchers or cash transfers get to poor people only. NREG has made some fair progress : the rich are unlikely to do uncomfortable physical labour in order to get paid by NREG. The UID will help in improving targeting of these kinds of schemes.

The CMIE survey data shows that the poor spend Rs.452 a quarter, on average, on cooking fuel. At the extreme, every one of these families can be given a voucher which entitles them to free fuel worth Rs.452 a quarter. This voucher system would cost the government Rs.8,000 crore a year. In other words, the existing system of distortions of the petroleum market can be replaced by a system where the 21.2% of poor households get free fuel, at the cost of less than 0.2 per cent of GDP.

This argument is not new, but it bears repeating because of the long history of policy mistakes in India on this subject. The other two issues are more interesting.

2 Smoothing over short-term fluctuations?

Suppose the world crude oil market works as follows: There is a deeper component to price movements, where changes are slow, and then there is short term noise on top of this. Sometimes prices go up and sometimes prices go down, but they tend to return to the long-run price which only evolves slowly.

If this were the case, you could make an argument that a government adds value by absorbing these short-term price fluctuations and only modifying domestic product prices to reflect the deeper price movements. This would help reduce noise in the decision making of the private sector. The private sector would adapt its technological choices (e.g. what energy source should be used for what application?) based on the deeper price changes, but not have to scurry around responding to day to day movements of prices.

Even if this story is true, we would need to demonstrate that the cost of the government's actions in achieving this stability are outweighed by the gains. So the existence of such patterns in price movements does not immediately justify an administered price system. But before we get to that, the key question is: Is this how the price of crude oil behaves? Does it have a component of short-term fluctuations which tend to be reversed?

This is the same as asking: Does the price tend to mean revert? I.e. when it goes up, on average does it tend to come back down, and when it goes down, on average does it tend to go back up? Are there negative correlations in price fluctuations in the short run?

Most prices in financial market exhibit little such

behaviour. Financial prices tend to be well approximated by the

`random walk'. The random walk never forgets. On average, changes are

not reversed: the market neither overshoots nor undershoots. The

autocorrelation function of percentage changes (i.e. returns) shows

near-zero values for autocorrelations.

Most prices in financial market exhibit little such

behaviour. Financial prices tend to be well approximated by the

`random walk'. The random walk never forgets. On average, changes are

not reversed: the market neither overshoots nor undershoots. The

autocorrelation function of percentage changes (i.e. returns) shows

near-zero values for autocorrelations.

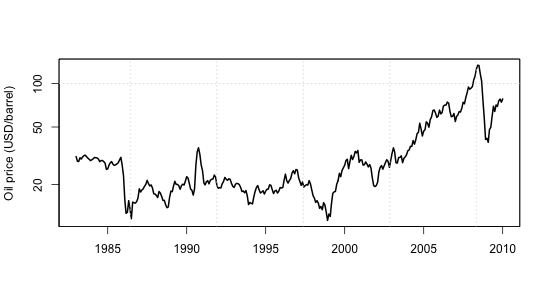

That may be true of financial prices, but what about crude oil? I focus on monthly data for the price per barrel expressed in USD, after January 1983, which is where OPEC's administered price system broke down. Is this more like a random walk or is it a mean-reverting process? As the graph (in log scale) shows, in these years, we have seen a huge range of values.

2.1 The level of the oil price

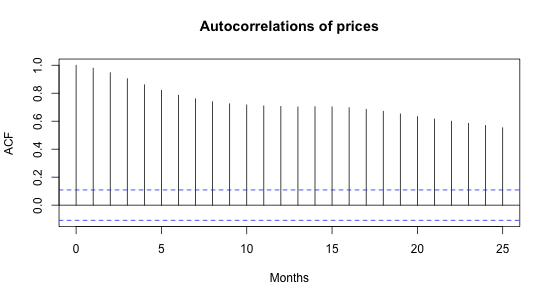

We start by looking at the autocorrelations of

prices (the correlation between the price this month and the price

last month). This looks a lot like a random walk, with very big

autocorrelations at the short end. In a random walk, the best

predictor of the price of oil next month is the price of oil this

month - there is no return to a `long-term level'.

We start by looking at the autocorrelations of

prices (the correlation between the price this month and the price

last month). This looks a lot like a random walk, with very big

autocorrelations at the short end. In a random walk, the best

predictor of the price of oil next month is the price of oil this

month - there is no return to a `long-term level'.

The ADF test has a prob value of 0.4. That is, the null hypothesis of a random walk is not rejected.

2.2 Percentage changes of the oil price

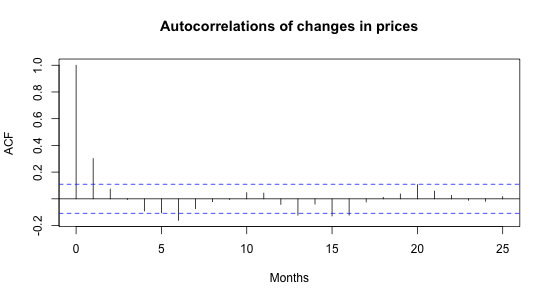

The story of the autocorrelation

function of monthly percentage changes is also interesting. We see a

little bit of momentum at the short end. There is one big value of

+0.3; the others are close to zero. That is, there is a +0.3

correlation of the change in the oil price in a given month against

the change in the oil price in the next month. This is

mean aversion, not mean

reversion. The price of oil is not going back (on average) to a

deeper stable level. It is mostly like a random walk.

The story of the autocorrelation

function of monthly percentage changes is also interesting. We see a

little bit of momentum at the short end. There is one big value of

+0.3; the others are close to zero. That is, there is a +0.3

correlation of the change in the oil price in a given month against

the change in the oil price in the next month. This is

mean aversion, not mean

reversion. The price of oil is not going back (on average) to a

deeper stable level. It is mostly like a random walk.

2.3 Implications

The oil price process surely has deviations from the random walk - one example was the +0.3 value for the first autocorrelation of monthly changes. Other kinds of deviations are also likely to exist. But the random walk is a good approximation. There is no evidence of mean reversion in a few months.

If we believe that the price of oil is a random walk, then there is no case for a government to help the economy by stabilising the price. Trying to hang on to last month's or last year's price is pointless because in a random walk, the only thing to focus on is today's price. The world oil price is not going (on average) to go back to what it was last year or last month. Changes are permanent (on average), and we get new shocks starting from where we are, not where we were.

A government that tries to hang on to a number will generally find that the market moves away from that number, with explosive fiscal consequences. One does not have much of a basis for claiming that any price is the `right one', and is more right than what the market is saying right now.

If the price of oil was mean-reverting, we could then ask whether the costs of administered pricing were outweighed by the benefits. But since the price of oil is mostly a random walk, there are no benefits. It is best if the private sector is constantly shown the current price, so that it is able to think about how to adapt technology and the capital stock to today's prices. We actually do damage by showing the private sector a stale price. We discourage the technological adaptations which the private sector should be constantly undertaking.

As the Kirit Parikh Panel says (para 2.4):

...attempts to insulate the domestic economy against volatility requires discriminating between a secular price rise due to demand-supply forces and a price rise due to transient causes such as speculation in the world market. This is difficult to do.

The reasoning above suggests that the conjectured `transient' component is essentially absent. This may help explain why India's experience with administered prices for petroleum products has been an unhappy one.

2.4 Unusual outbursts of volatility?

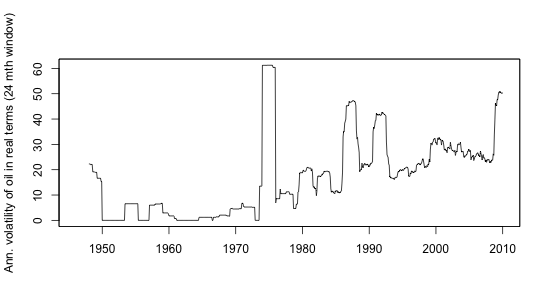

One variant of this story that we sometimes hear is: Floating rates

are fine for normal times but in extraordinary times, the government

needs to intervene in the market. The great boom and bust of oil

prices in the recent few years is held up as an outlandish set of

events. This raises the question: Was oil volatility exceptionally

large in the recent few years? In order to address this, I graph

the volatility of the world oil price, with a rolling window of width

24 months. In the recent period, oil volatility has been running at

values of 40% to 50% annualised. These values are not exceptional when

compared with the historical experience. Odds are, we will see such

volatility in coming decades also. The recent few years were not just

an outlandish set of events.

One variant of this story that we sometimes hear is: Floating rates

are fine for normal times but in extraordinary times, the government

needs to intervene in the market. The great boom and bust of oil

prices in the recent few years is held up as an outlandish set of

events. This raises the question: Was oil volatility exceptionally

large in the recent few years? In order to address this, I graph

the volatility of the world oil price, with a rolling window of width

24 months. In the recent period, oil volatility has been running at

values of 40% to 50% annualised. These values are not exceptional when

compared with the historical experience. Odds are, we will see such

volatility in coming decades also. The recent few years were not just

an outlandish set of events.

In this graph, one is looking into the period prior to 1983. There, the mean and variance of US inflation was significantly different from that prevalent in the Volcker/Greenspan/Bernanke periods. Hence, the volatility graph is computed off the price of oil in USD re-expressed in real terms.

3 Floating vs. administered petroleum product prices and their impact on inflation or inflation volatility

What are the consequences of the floating vs. administered regime (in petroleum products) for the level and volatility of inflation? There are fears that inflation will go up, or the volatility of inflation will go up, if we move to a system where product prices fluctuate every day. There are three interesting aspects to this problem.

3.1 Small shocks vs. big shocks

First, since administered prices have to ultimately be adjusted to catch up with the random walk, the two alternatives really only constitute a choice between a large number of small adjustments versus a small number of big adjustments. It is likely that administered pricing involves bigger macroeconomic shocks to the system. As with the experience with ending administered pricing of cement and steel suggests, the economy adjusted quite well to the idea that the price of cement or steel fluctuates every day. There is no reason why this could not happen to the price of petroleum products.

3.2 Standard price indexes understate the adjustments of the economy

The second point is about measurement. In our intuition, we think of the CPI as a weighted average of a bunch of prices. The moment petroleum product prices go up, the CPI goes up. This is the first order inflationary impact of the rise in prices of petroleum products. This intuition is flawed.

The true inflationary impact of a rise in the price of any one commodity (e.g. petrol) is smaller than it appears, because households have an overall budget constraint, and switch consumption away from more expensive petrol to other commodities. The standard microeconomic responses -- through substitution and income effects -- generate higher payments for petrol and lower payments for all other commodities. The quantities of petrol versus other commodities change in response to a price hike in petrol. The reduced demand for other commodities induces somewhat lower prices for those.

A general equilibrium analysis is required, and the result differs substantially from the partial equilibrium calculation that is embedded in the computation of the WPI or the CPI, where the weights are held fixed and only prices change. Computation of the CPI with a fixed set of weights misses out on the adjustments of households, and overstates inflation.

3.3 Credibility of monetary policy

The third point which deserves attention is the macroeconomic dimensions of the transmission of a rise in petroleum product prices into broad-based inflation. When consumers see a rise in inflation caused by a rise in petroleum product prices (or vice versa), how do they react? Do households demand higher wages? Do firms pass on price increases? Do inflationary expectations get built up, and do we get an inflationary spiral? The extent to which this takes place is critically about the information set of households, the monetary policy framework, and the credibility of price stability.

Monetary policy in India from Governor Rangarajan onwards, has increasingly focused on price stability as a major goal. This approach has been underlined by the Percy Mistry and Raghuram Rajan committee reports, and is reflected in the strong expectations in the broader economy that the foremost task of RBI is to work towards price stability. With the passage of time, RBI would gain credibility as being focused on delivering low and stable inflation. In this case, households and firms would know that the central bank will deliver on stable inflation in the medium term. In this case, households and firms are less likely to react to short-term small fluctuations in inflation through wage hikes or increases in product prices.

As the Kirit Parikh report says:

4.13 With deregulated oil prices, once households and firms clearly see that international factors drive domestic petroleum product prices, and when monetary policy is seen to emphasize price stability, households and firms would be relatively relaxed. When there is a temporary shock to oil prices, they would be much less likely to react to short-term fluctuations in prices through wage hikes or increases in product prices. Thus, in OECD countries, from 1979 onwards, where central banks have shifted into de facto or de jure ``inflation targeting'', the great commodity inflation from 2002 onwards did not pass through into broad-based inflation in the 2002-2008 period.

We should decontrol petroleum product prices right away, because this makes much sense. In the short run, while India has not yet perfected the institutional mechanism of monetary policy, this will yield somewhat increased volatility of inflation in the short run (while avoiding the big shocks to inflation when administered prices were adjusted by large amounts). In the future, when the institutional capability of monetary policy improves, we will reap the benefits of this in terms of households and firms being more likely to take global commodity price fluctuations in their stride.

More generally, a sophisticated monetary policy capability is an integral part of the market economy. Infirmities in the market economy (e.g. the lack of a bond market or capital controls) inhibit the effectiveness of monetary policy. Infirmities in monetary policy (e.g. lack of de jure inflation targeting) inhibit other reforms such as ending administered pricing for petroleum products.

Back up to Ajay Shah's 2010 media page

Back up to Ajay Shah's home page