A bad time for a crisis

Business Standard, 12 December 2016

We in India are absorbed in de-monetisation. This crisis has come in a particularly difficult global context. In China, Europe and the US, there is great stress and impending economic distress. This harms the prospects of an Indian economic recovery by giving us weak external demand. These difficulties have already given us a sharp downturn in goods and services exports by listed firms, where data is observed till the Jul-Aug-Sep 2016 quarter. A buoyant world economy has helped power Indian business cycle recoveries in the past. This is unlikely in 2017.

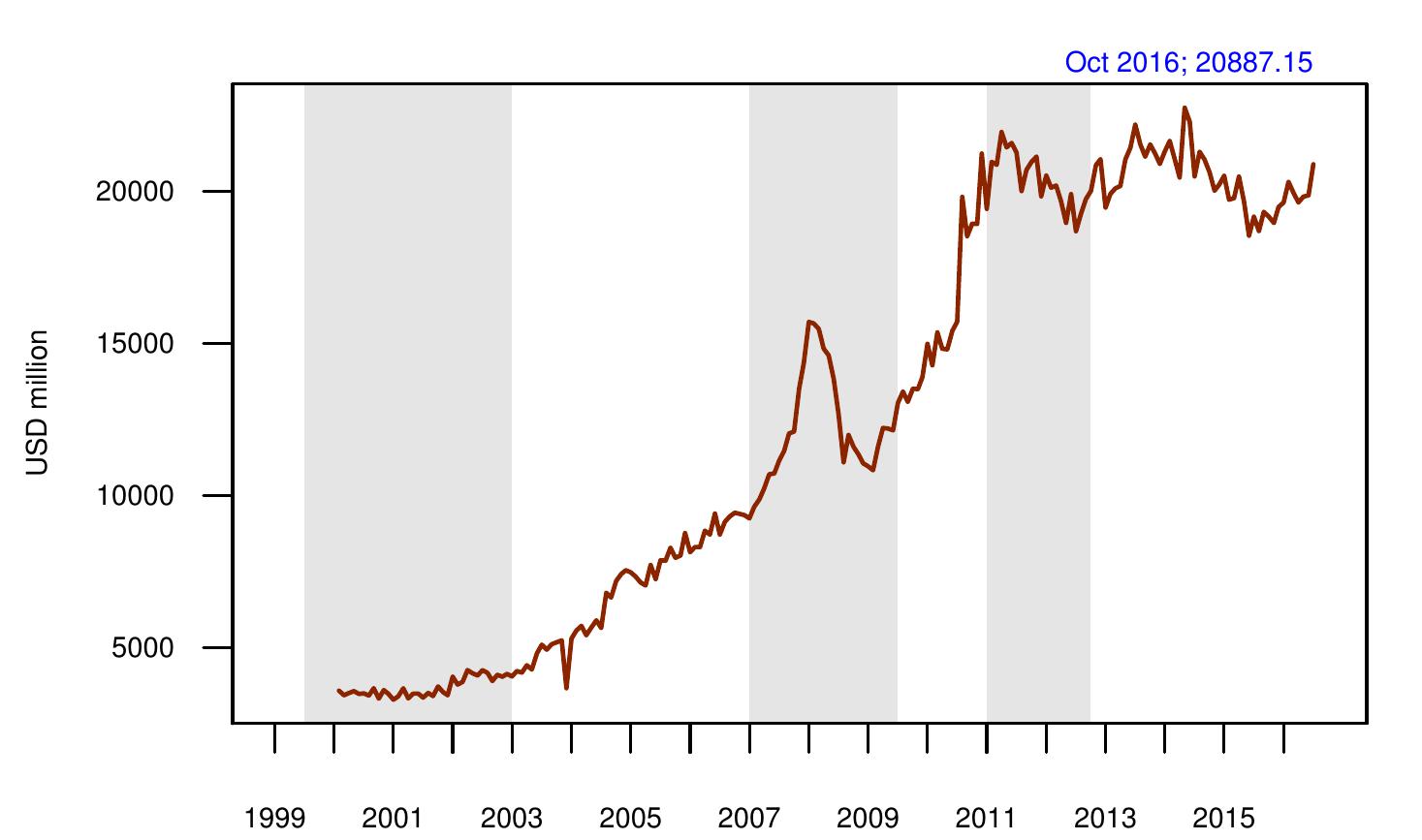

A little noticed fact about the recent

years has been the problems of exports. The graph shows the seasonally adjusted level of non-oil goods exports, measured in million dollars per month. For a long period, we had strong growth, from the region of $5 billion a month in 2002 to $20 billion a month by 2011. But after that, we've been stuck with no growth from 2011 to 2016. (This covers goods but not services exports).

A little noticed fact about the recent

years has been the problems of exports. The graph shows the seasonally adjusted level of non-oil goods exports, measured in million dollars per month. For a long period, we had strong growth, from the region of $5 billion a month in 2002 to $20 billion a month by 2011. But after that, we've been stuck with no growth from 2011 to 2016. (This covers goods but not services exports).

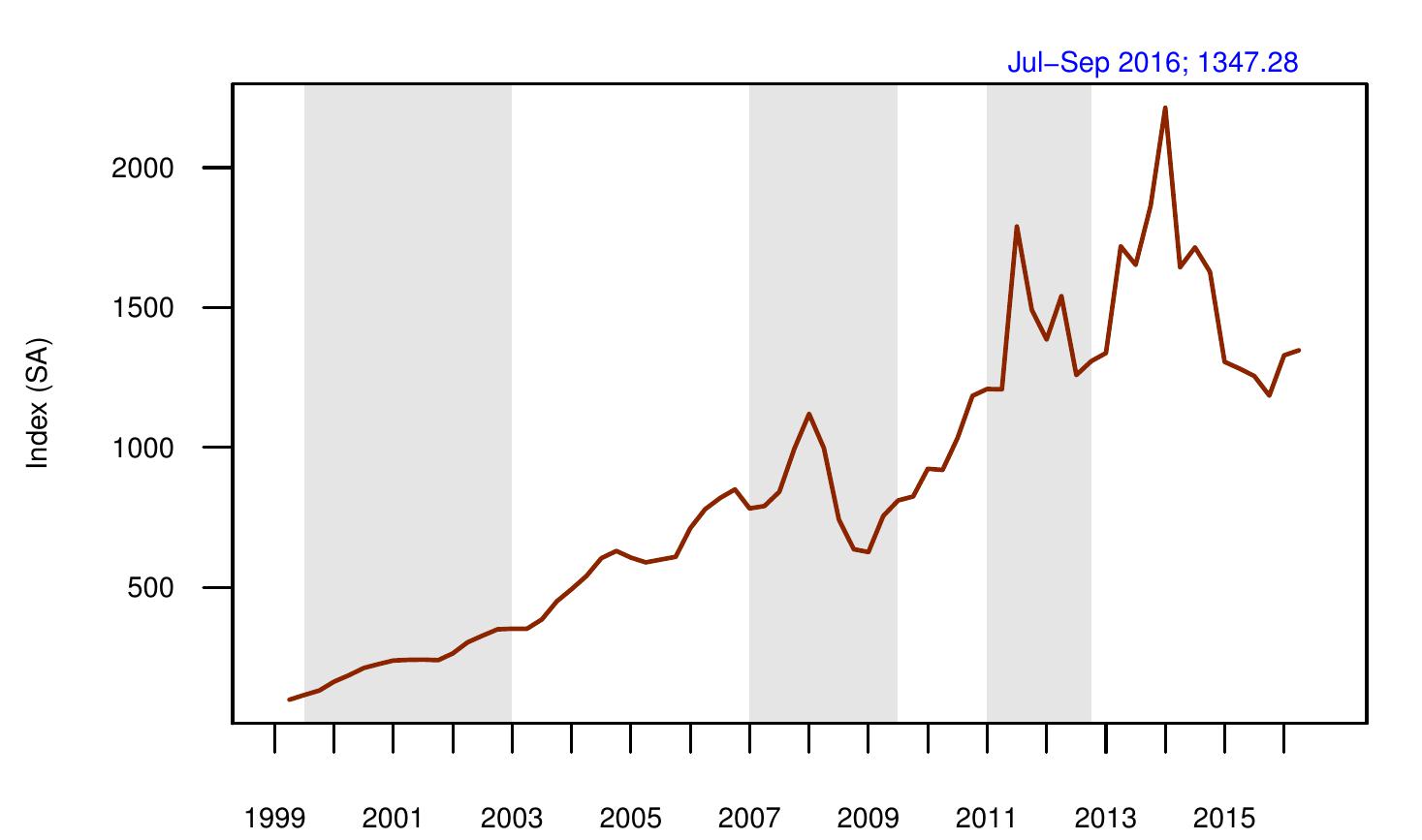

Things are worse when we look at the exports of large firms (both goods and services). Let's look at the exports of non-finance non-oil listed companies. This second graph shows an index number series for firm exports. From Q4/2013 onwards, the compound average growth rate of exports has been -17.5% per year.

Things are worse when we look at the exports of large firms (both goods and services). Let's look at the exports of non-finance non-oil listed companies. This second graph shows an index number series for firm exports. From Q4/2013 onwards, the compound average growth rate of exports has been -17.5% per year.

Part of this has to do with the exchange rate policy followed by the government from 2013 onwards. The remainder has to do with the sluggish world economy which lacks buoyancy of demand. Looking forward, there are difficulties in Europe, China and the US, which suggest that weak demand will persist.

Europe is not faring well. The Greek crisis rocked the globe. Similar problems lurk in other southern European countries like Italy. Southern Europe is trapped between two rival problems. To get back to growth, they need a substantial reduction in domestic prices and wages. This deflation would make debt servicing impossible. But if this deflation does not take place, growth is near zero, which makes debt servicing impossible.

The political capacity for thought and action on economic questions in Europe has been sapped by Brexit, the refugee crisis, and the resumption of hostilities with Russia. Liberal democracy has collapsed in the heart of Europe, in countries like Hungary. Angela Merkel is now the most important world leader who stands up for liberal democracy, and this is a heavy burden.

Under this combination of economic and political stress, it is hard to obtain strong growth in Europe. We are likely to collapse into periodic episodes like the Greek crisis. Italian outstanding debt is roughly 10 times larger than Greek debt, so difficulties in Italy are an entirely different scale of problem when compared with Greece.

China is not faring well. The `China model', of command and control, industrial policy, State-led development, minus civil liberties and the rule of law, did not work out. From Deng Xiaoping's time, there was a hope that China would be able to gradually evolve into a more humane political system. Under Xi Jinping's rule, these hopes have faded. China seems stuck with autocratic rule, much like the USSR and Russia. The Chinese elite is unconfident about its future in China, and is sending assets and family members out of the country.

Vast sums of money are leaving, partly out of mistrust of the China model, and partly as a speculative play on the view that the Chinese RMB will depreciate. The problem has been exacerbated by the strong dollar of recent weeks. This is shaping up as the biggest currency crisis in world history. The Chinese currency defence is now moving into the toxic phase (recall India in May 2013) where unpleasant things are done to defend the exchange rate, which damage growth.

The US is not faring well. Donald Trump is likely to bring together the least impressive cabinet that the US has seen in a century. Trump and his friends are proud of their election success, and look down upon the wonkish details of policy. But their understanding of the complexities of government is questionable. Second rate people hire third rate people, and there is the risk that the top 4000 odd positions in the US Federal Government will add up to a weak top management team. There is the danger that major decisions will be made by a few people in secrecy, without the refinement of ideas and the project planning that takes place through the wonkish process of intellectual analysis, democratic discussion and methodical project planning.

Success in real world public policy requires a leadership that appreciates intellectual complexity, and has an emotional comfort with people who understand government. An intellectual and emotional connect with the world of ideas is required in reaching out to expertise, and in listening to them. The Trump team is emotionally distant from the experts; it is almost proud of being tone deaf on the complexities of public policy. They may resort to policy adventurism, carrying catchy slogans and half baked ideas into the domain of execution. They will then lurch from one crisis to another.

With a difficult outlook in Europe, China and the US, it is likely that global demand for exports will not help carry our burden in India. Goods and services exports by the listed companies grew by an average of 35% from 1999 to 2005, which helped power us out of the recession of 1999-2003. Similarly, goods and services exports by the listed companies grew by an average of 24% from 2008 to 2013, which helped power us out of the recession of 2007-2008.

Business cycle recoveries in India are about surges in export demand and in investment demand. We do not know how bad the de-monetisation recession will be. But the timing for this was particularly unfortunate, given that one of the two pathways for recovery faces difficulties.

In India, we got a business cycle downturn in 2012. With de-monetisation and difficult global conditions brought into the picture, the difficulties have deepened. Now the story will turn on the extent to which private firms get back into investing. This requires three things: capacity has to be utilised, profit margins have to be good, and the firm has to have the corporate financial depth to embark on large projects.

Back up to Ajay Shah's 2016 media page

Back up to Ajay Shah's home page