Goods exports from India: Some of the gloom is unjustified

Business Standard, 26 July 2021

It is widely believed that China is vastly ahead of India on goods exports. While this is true in absolute terms, in relative terms the picture has been shifting. We use data for goods imports by the US, from the two countries, to illustrate this phenomenon. In a difficult time in the Indian economy, the key focus of strategic thinking in firms should be to prioritise exports, of not just services but also goods.

China is an incredible success, on a global scale, in the export of goods. Not only have they achieved gigantic magnitudes, they have also walked up the value chain, all the way to machine tools and computers. Investors and managers often dare to dream when it comes to services exports from India, but tend to be skeptical about business plans that involve the export of goods. The evidence suggests a certain rethink of these stereotypes is called for.

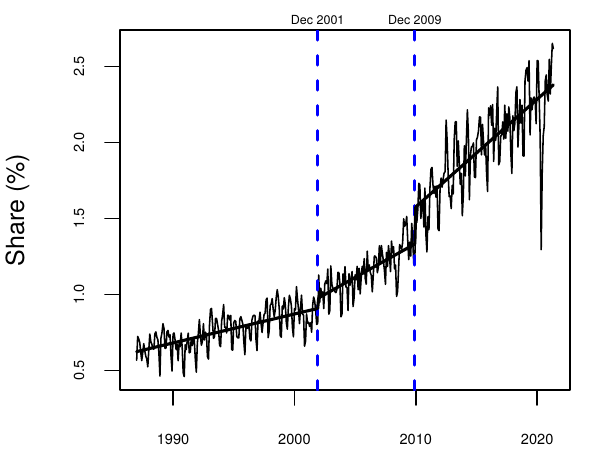

Chinese and Indian data suffers from problems of measurement owing to the misinvoicing that is encouraged by capital controls and tax policy. Hence, it is useful to focus on the monthly data on goods imports into the US, from the two countries. It is likely that the numerical values seen here will be more accurate when compared with home country data. We focus on India's share in US goods imports. This time-series is shown in the graph.

Figure: India's share in US goods imports (per cent)

The data starts from January 1987, and in the first period, India's share was going up by 0.0016 percentage points per month. There was a first structural break in December 2001. After this, India's share started going up at a faster pace, with a gain of 0.0037 percentage points per month. Finally, there was a second structural break, in December 2009. After this, India's share has been rising at the rate of 0.0059 percentage points per month.

India remains a small part of US goods imports, with a present share of 2.6%. But contrary to widespread export pessimism in India, this share has been rising, and at an accelerating rate.

How did these gains arise?

How did these improvements in goods exports come about? What were the policy inputs in the years before 2001 and 2009 which kicked off the acceleration of India's share in US goods imports that is seen in December 2001 and December 2009?

There were three main elements in the story. The first element was removing barriers to imports. Making the Indian market more open for imports was a central theme of the reforms that began in 1991. When customs duties, and non-tariff barriers, are reduced, raw materials in India become cheaper. This makes exporters more competitive. In the Ministry of Finance of old, Rakesh Mohan used to say "Every time we cut customs duties, exports go up". The NDA-1 government cut customs duties significantly.

The second element was removing barriers to capital flows. Foreign companies utilised FDI liberalisation to build operations in India and export from India. Foreign companies have access to global corporate financial arrangements -- at a world class price of capital -- while Indian companies do not. For a steel company, capital (equity or debt) is as much a raw material as iron ore or coal. The reduction of capital controls made capital (both equity and debt) available to Indian companies at a lower price, which made them more competitive and able to export.

The third element was the improvements in infrastructure, which helped India connect into global value chains, and made it possible for producers in India to go into the hinterland in the search for cheaper labour.

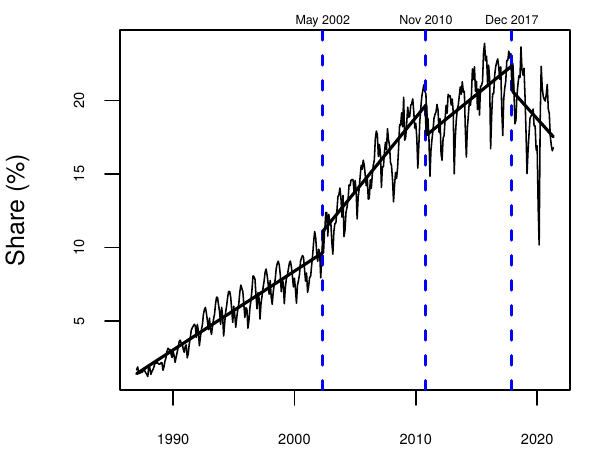

How has the Chinese share evolved?

Figure: China's share in US goods imports (per cent)

Alongside this, it's interesting to look at what has been going on with China's share in US goods imports. At the start, in January 1987, China's share was 1.7%. It grew dramatically to a peak value of 23.3% in September 2017. Over this period, there was an average gain in market share at a remarkable rate of 0.06 percentage points per month. In recent years, this share has dropped quite a bit, to a latest value of 16.8% in May 2021. China has been retreating into nationalism and authoritarianism, and the boards of global companies are responding by reducing the role of China in global production.

Implications

We could say the glass is half empty. In the bottom line, China's share in US goods imports is 16.8% while India is at 2.6%: a gap of 6.4 times. But the glass is also half full. Through the entire period, India's share in US goods imports has risen, and the per-month rate of gain has accelerated twice.

Among investors and managers, there is often a sense that India is a good platform for services production. The evidence shown here helps us be more optimistic about goods export from India also. India is slowly gaining share in US goods imports.

Similarly, among investors and managers, there is a sense that China is a manufacturing powerhouse and it is impossible for India to play in that space. The evidence shown here suggests the direction of change is in India's favour. From October 2017 onwards, China's goods exports have lost ground in the US to the extent of 6.5 pp while India has gained 0.4 pp.

We are in a difficult period in the India economy, with weaknesses in government demand, consumer demand, and private investment demand. The world economy is recovering well, reflecting strengths in fiscal capacity and vaccination. Firms in India have much to gain by prioritising the export sector, either directly by exporting or by selling to exporting firms. If we define December 2019 as the pre-pandemic month, and compare this against the latest value of May 2021, Indian goods exports to the US were up by 41%. There is no other element of the Indian economy where there are such gains compared with pre-pandemic conditions.

Back up to Ajay Shah's 2021 media page

Back up to Ajay Shah's home page