How much reserves is required for achieving safety?

Financial Express, 25 April 2009

How much reserves should a country hold? Prior to the global financial crisis, these debates were a stab in the dark, where reserves were intended to protect against an un-knowable future crisis. Now we have a better factual base about how much reserves is useful in a mighty crisis. In India's case, the magnitudes required seem to be small. And, even if reserves are enormous, using them in a crisis is troublesome. If it is insurance that is desired, perhaps it can be better achieved through other means.

What happened to reserves?

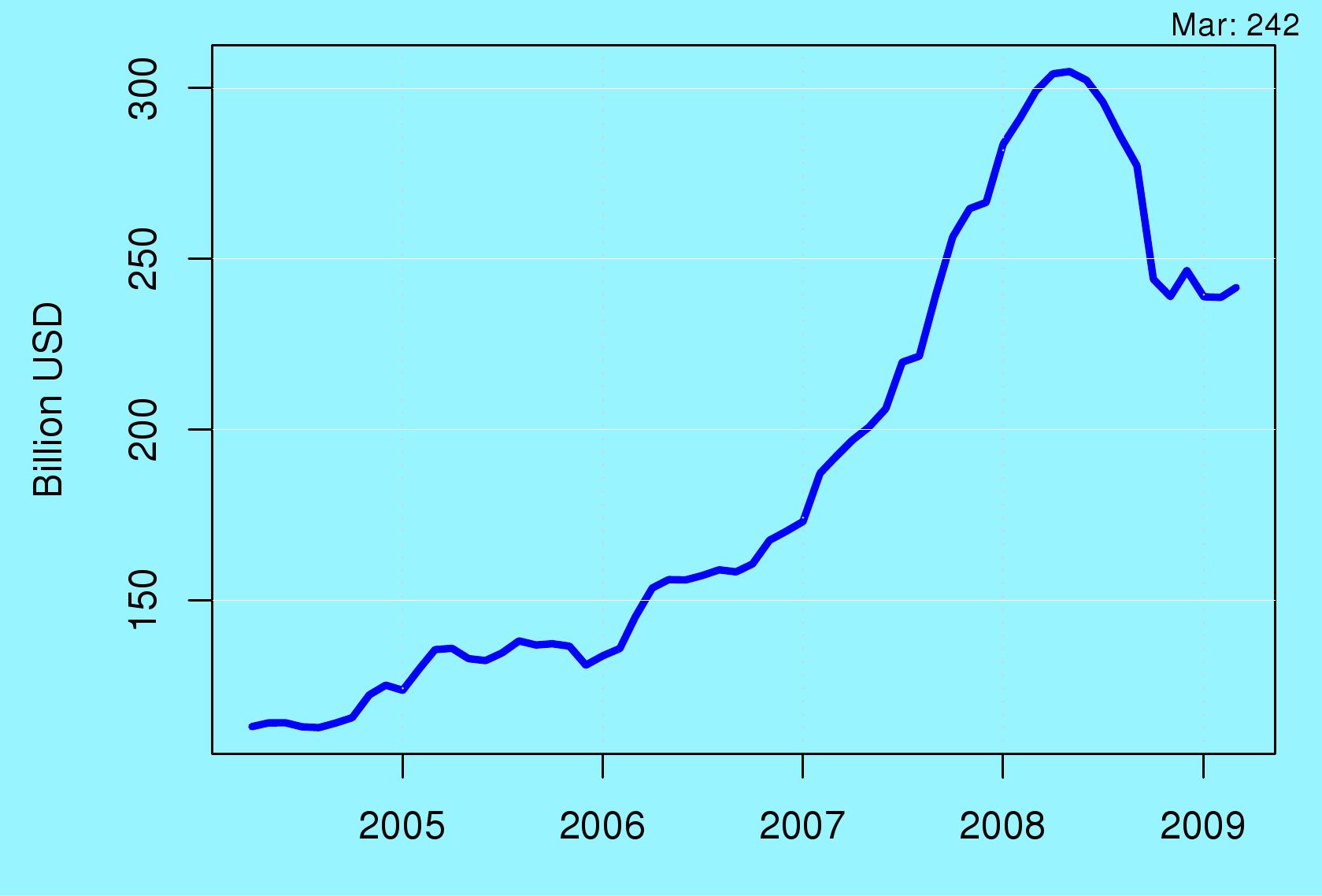

India's reserves holding peaked at $305 billion or 30% of GDP, in May 2008. One reason for holding reserves is to be able to "defend" the currency in a time of crisis. Debates on reserves adequacy in the pre-2008 period involved optimists who thought that one didn't need much, and pessimists who warned about horrible crises in which reserves would need to be sold on a massive scale.

India's reserves holding peaked at $305 billion or 30% of GDP, in May 2008. One reason for holding reserves is to be able to "defend" the currency in a time of crisis. Debates on reserves adequacy in the pre-2008 period involved optimists who thought that one didn't need much, and pessimists who warned about horrible crises in which reserves would need to be sold on a massive scale.

We got a pretty bad crisis, worse than the worst portrayed by the pessimists. Nobody had imagined a world where the VIX would exceed 80%, where AIG and Lehman would go bankrupt. This has been a once-in-a-century crisis. So if we wanted a natural experiment of sale of reserves in a bad crisis, we got it. And the optimists turned out to be right.

RBI's trading on the currency market

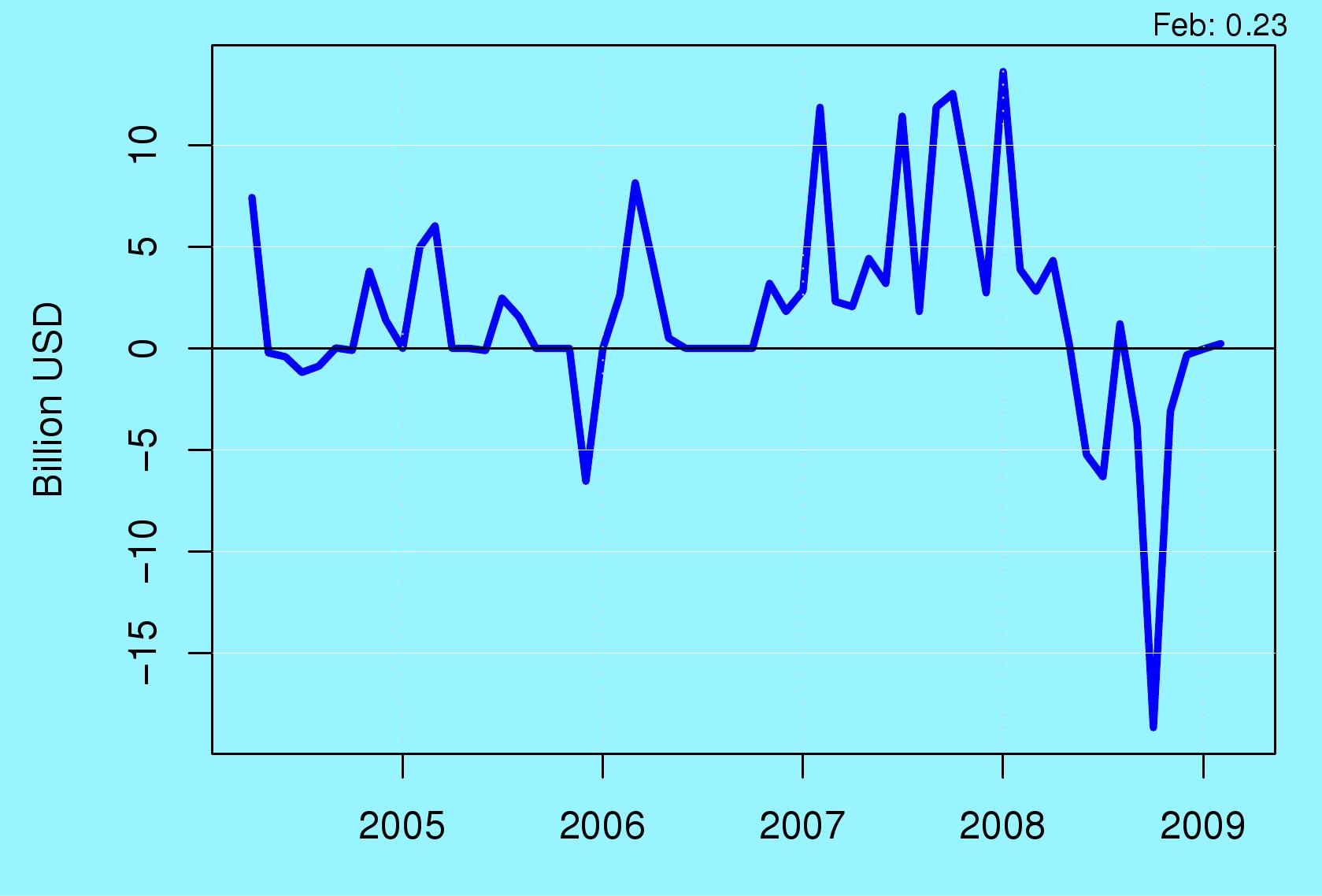

Sale of reserves commenced in June 2008, a bit before things got really bad. The total sale of reserves from June to December added up to $36 billion. In other words, the amount of reserves actually used for insurance purposes in the worst financial crisis of a century was roughly one-ninth of the hoard that India had built up.

Sale of reserves commenced in June 2008, a bit before things got really bad. The total sale of reserves from June to December added up to $36 billion. In other words, the amount of reserves actually used for insurance purposes in the worst financial crisis of a century was roughly one-ninth of the hoard that India had built up.

The sale of reserves was concentrated in October, where $18.7 billion was sold. In November, $3.1 billion was sold. In the following months, roughly nothing was sold; in fact, in February, $0.23 billion was purchased.

Reserves have declined by more than $36 billion. This reflects fluctuations of the currencies in the reserves portfolio. RBI has diversified the portfolio away from the USD. This is the prudent thing to do. However, in recent events, the non-dollar currencies in the reserves portfolio did badly. Hence, India suffered from capital losses on the reserves portfolio. As a result, the reserves portfolio is down by a total of $63 billion, with sale of reserves of $36 billion and capital losses of $27 billion.

This suggests that at India's present level of globalisation, sale of reserves will not exceed 4% of GDP in a very bad crisis. India's global integration will, of course, rise dramatically in the years to come. Further, the sight of substantial reserves might have helped anchor foreign investors in India. These considerations suggest reserves of 10% of GDP or $100 billion are adequate for insurance purposes.

Why were reserves used so little in crisis?

Three factors were at work:

- In a time of crisis, if the central bank sells reserves to prevent rupee depreciation, it actually kicks off a generalised asset price collapse in the domestic economy, as people try to sell off shares or bonds or houses and get their money out of the country at a distorted exchange rate. Intuitively, temporarily propping up the currency in a time of crisis is the same as supporting the exit of foreign investors at an advantageous price. These considerations restrain central banks from manipulating the currency market in a time of distress.

- Further, in a downturn, a rupee depreciation is a good thing: it improves profit rates in the tradeables sector and boosts exports. Selling reserves to stave off a currency depreciation at such a time is unwise.

- Finally, the greatest source of confidence for foreign investors is a currency that reflects market forces and not the views of a central bank. A market-determined floating exchange rate is more credible and more believable than a manipulated administered exchange rate. In a time of crisis, every drop of credibility matters.

By and large, RBI did the right things in terms of selling some reserves, so as to give dollar liquidity to Indian firms who had overseas obligations. This could have been structured in a more transparent manner, by having open auctions where firms bought dollars from RBI.

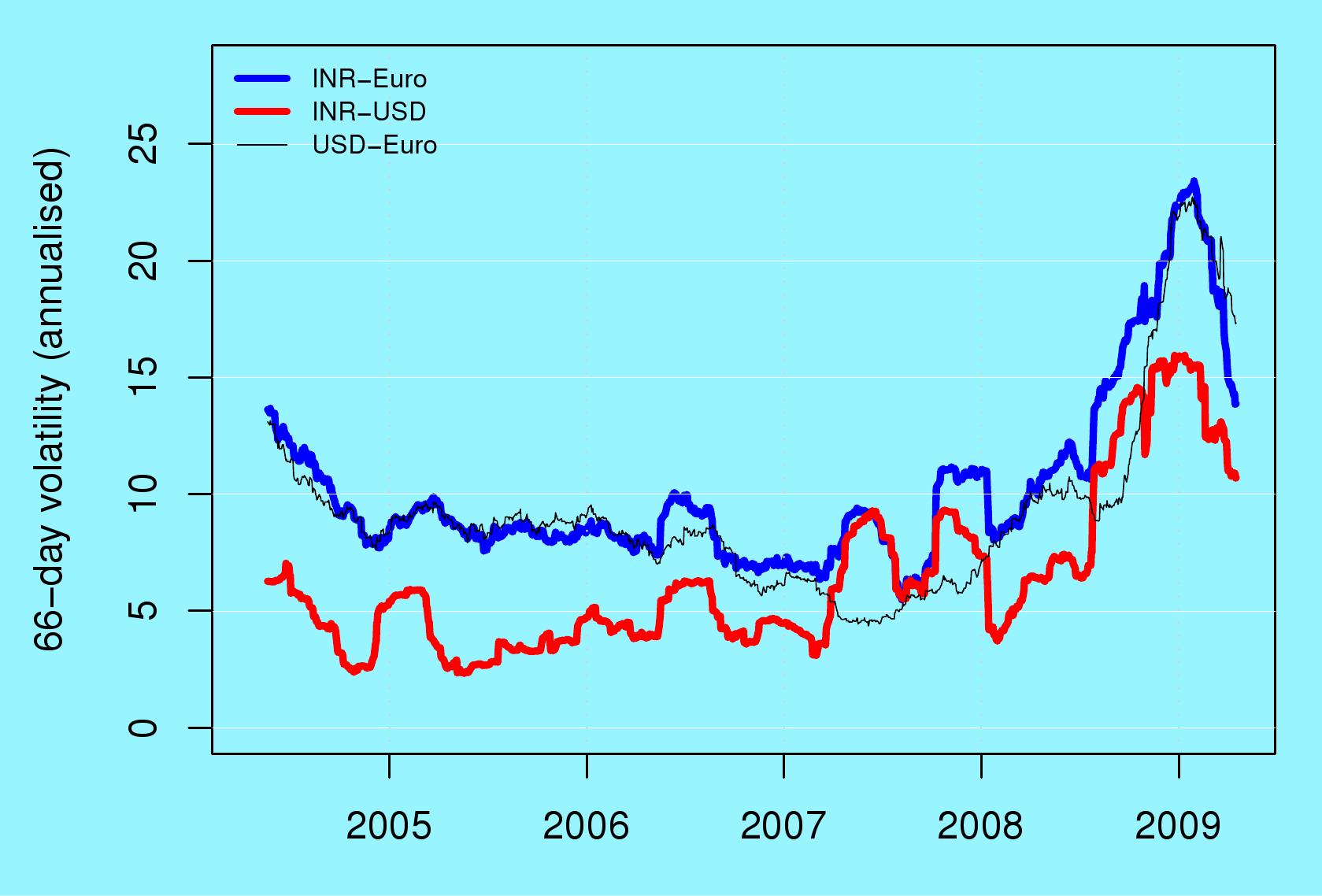

What happened to currency flexibility?

Barring that, RBI responded to the crisis by floating the rupee, and not manipulating the exchange rate through sale of reserves. The lack of RBI trading from December 2008 till February 2009 is one of the things which has gone right in India's responses to the crisis.

Barring that, RBI responded to the crisis by floating the rupee, and not manipulating the exchange rate through sale of reserves. The lack of RBI trading from December 2008 till February 2009 is one of the things which has gone right in India's responses to the crisis.

This sudden change in course -- from pegging to floating -- did substantial damage to the economy, by hurting the firms who had got used to the pegged rupee-dollar rate. The lesson we should draw from this is to have a floating exchange rate in good times and in bad; to never give out such expectations to the private sector.

What are cheaper ways of obtaining insurance?

These complexities underline how reserves are actually a poor form of insurance. If insurance is desired, it can be obtained frontally using derivatives. As an example, India could enter into derivatives contracts which pay $50 billion to us when the world economy goes into stressed conditions, based on defined trigger values of indicators such as the Vix, the Moody's Baa spread, the TED Spread and the EMBI. This would come at a lower cost as compared with large holdings of reserves.

Back up to Ajay Shah's 2009 media page

Back up to Ajay Shah's home page