The setting for the budget speech

Financial Express, 25 May 2009

The Congress victory has generated immense optimism for the outlook for the economy. It is useful to take stock of where we are in terms of business cycle conditions, which can help shape the strategy of the policy response.

What drives Indian business cycle fluctuations?

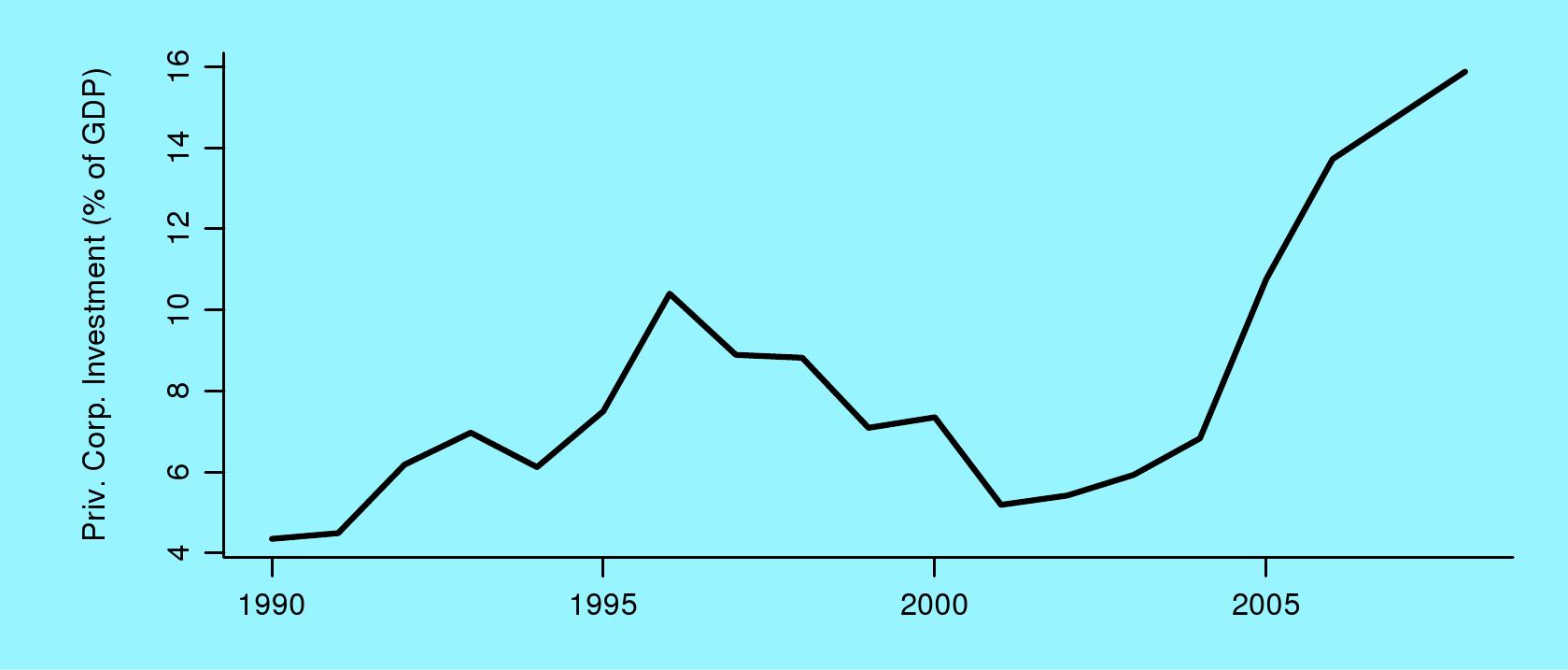

The most important determinant of business cycle conditions in India is private corporate investment. The Figure shows what has happened to private corporate investment, as percent of GDP, from 1989-90 till 2007-08. This data is not available for 2008-09 or 2009-10.

The most important determinant of business cycle conditions in India is private corporate investment. The Figure shows what has happened to private corporate investment, as percent of GDP, from 1989-90 till 2007-08. This data is not available for 2008-09 or 2009-10.

The economic reforms of the early 1990s got private corporate investment up from the region of 4% to a peak of 10%. This six percentage point increase of private corporate investment generated a strong business cycle expansion.

The decline of private corporate investment back to values like 5% was the essence of the business cycle downturn of 2001-2002. After this, we have seen an immense expansion of private corporate investment -- all the way to 16%. This is the essence of the benign business cycle conditions of recent years.

The most important question that will shape business cycle conditions in 2009-10 and 2010-11 is: by how much will private corporate investment decline? It is important to see that today, each percentage point of GDP is Rs.55,000 crore, so we are discussing massive numbers. If a decline of private corporate investment takes place from 16% to 10%, then this is a reduction of demand by 6 percentage points of GDP or Rs.330,000 crore. When private corporate investment goes down, the overall impact on GDP is magnified through multiplier effects.

The shocks to GDP that are generated by these fluctuations of private corporate investment are so large that monetary or fiscal policy, as presently organised in India, can simply not counteract them. The only place where public policy can make a difference to this is to identify the policy instruments through which private corporate investment can flourish.

What has happened in recent months?

From this backdrop, we now turn to information from recent months. A key flaw of data handling in India today is the use of year-on-year growth rates. The change from February 2008 to February 2009 is the sum of 12 changes, one per month. If we are interested in recent events, it is more important to look at the change of each month. These month-on-month fluctuations can be distorted by seasonal effects. As an example, prices are likely to go down in October because the harvest comes in. Hence, what is required is seasonally adjusted month-on-month changes. We have implemented these procedures for many Indian monthly time-series of interest.

How have global conditions adversely affected the domestic economy and particularly private corporate investment? Two channels are at work. The first is export demand. Non-oil exports growth has been negative from July 2008 onwards. Seasonally adjusted non-oil exports (expressed in rupees) declined in each month from this date onwards.

The second channel is the profitability of the tradeables sector. For a large number of goods - such as steel - the domestic price is now the same as the world price, reflecting India's new-found trade integration with the world economy. Hence, soft economic conditions worldwide are propagating into India, yielding reduced prices of tradeables, reduced profit rates and thus reduced investment in India. The WPI manufacturing is a good measure of what is going on with tradeables. This has shown deflation (i.e. decline in prices) for every month from September 2008 till February 2009.

Non-food credit is an important indicator of how the economy is faring. In the business cycle expansion, annualised growth rates of 15% to 25% were prevailing. These ebbed away to 14% in October, 7% in November, 2% in December and 0% in January. Growth improved slightly to 7% in February.

The problem of private corporate investment

Good monthly data on investment is not available. But the above factors suggest a gloomy environment for investment demand, particularly the investment by companies producing tradeables. It is important to see that what we have experienced is not just an October/November shock. Exports have shrunk in each month from July 2008 onwards. Tradeable prices have declined in each month from September 2008 onwards. Each month, conditions have become worse than in the previous month. In thinking about this, it is particularly important to focus on month-to-month changes as opposed to the 12-month moving average which year-on-year changes show. Conditions with non-oil exports, WPI manufacturing and non-food credit are all at levels comparable with those found in the crisis of the early 1990s.

What determines fluctuations of corporate investment? Investment is critically about `animal spirits'. CEOs build factories when they are feeling optimistic about the world (and vice versa). As the graph shows, private corporate investment surged after confidence was created that India was on the right track in economic reforms. Once an expansion commences, it tends to feed on itself, but policy triggers are of critical importance in inducing turning points.

With conditions reminiscent of the early 1990s in terms of an economic downturn, it is fitting to emphasise the importance of a budget speech comparable to that which Manmohan Singh as finance minister delivered on 24 July 1991. If this speech is able to break with the stasis of recent years, and put economic reforms back on track, it would be able to stave off the scenario of a sharp decline in private corporate investment. If, on the other hand, the coming budget speech is not seen as a leap forward for economic reforms, then business cycle conditions will appreciably worsen in 2009-10.

The six areas where the budget speech has to deliver

I The problems of fiscal, financial and monetary institution building

India has stumbled into modernity, with business cycle fluctuations now taking place in an increasingly open economy setting. However, the institutional machinery for fiscal, financial and monetary policy was designed in the middle of the 20th century. This institutional machinery needs to be overhauled, so as to bring it in touch with the needs of todays India.

This involves an FRBM-II, which should ensure that the debt/GDP ratio does not stray beyond 60% of GDP, which ends the off-budget borrowing which plagued public finance in recent years, and yields deficits that go down in good times so as to be able to enlarge in bad times.

Investment banking for the government is presently done by RBI, which also regulates banks and sets the short-term interest rate. All these three functions suffer from conflicts with each other, as was sharply visible with the difficulties of government borrowing in recent months. RBI needs to be unburdened of this conflict of interest by placing the investment banking function in a separate agency, as is the best international practice.

In international comparisons of central bank transparency, RBI comes out at the bottom. While this might have been acceptable in previous decades, there is now an increasing push in India - in the spirit of the RTI - to use transparency as a tool for better governance. In a democracy, every public agency must be fully transparent to the public, so as to enable accountability. Central banks, in particular, require transparency in order to be effective. RBI transparency needs to now be brought up to the levels found in Brazil or South Africa.

Regulation and supervision of financial markets in India is fragmented between SEBI (for the stock market and the corporate bond market), FMC (for commodity futures) and RBI (for the currency and interest rate markets). A series of expert committees have recommended that this would work much better if all these were unified at a single agency, as is the best international practice. In a similar vein, it is finally time to pass the PFRDA Bill, and properly setup the New Pension System, with a project management attitude targeting 20 million individuals into the NPS within the coming five years.

While India has made enormous progress with the stock market, banking reforms have been stalled for a decade. In numerous industries in India, such as telecom or airlines, the benefits of competition have been reaped. This needs to be done with banking also, by removing barriers against opening branches or banks. This needs to go along with setting up a meaningful deposit insurance corporation, which will handle failed banks. Finally, the existing policy framework on `financial inclusion' has been tried for 40 years and has failed. It is time to question the basic assumptions of the status quo and set course for new ideas.

II Financing of the government

The upsurge of the fiscal deficit in recent years has led to a corresponding upsurge of the debt stock. The fiscal space available for the government is now significantly constrained owing to the higher interest payments that are required owing to this newfound indebtedness. In the long run, fiscal prudence and the FRBM-II can bring debt back down to modest levels. But for the coming five years, if the UPA wants to spend money on its flagship welfare schemes, fiscal space will have to be created through asset sales. A fresh focus needs to be put on identifying and selling off assets of the government.

There is a universal consensus on the appeal of the Goods and Services Tax (GST). The introduction of the GST will end a series of distortionary taxes, such as the Stamp Duty, Octroi, electricity duty, etc. It will make possible India as a single common market. By enlarging the base, it will be possible to reduce the rate, and thus obtain benefits of reduced compliance and reduced distortions. The challenge now is one of a coordinated movement by the centre and the states towards a single IT system through which the GST is administered. This IT system can draw a lot of ideas and technology from the work that NSDL has done for automation of income tax.

While the GST will end some bad taxes such as stamp duty and octroi, it will not end others such the securities transaction tax, the education cess or customs duty. The UPA needs to announce that it will not violate internationally accepted principles of sound taxation, so that central tax revenue will only come from the income tax and the GST.

With acute fiscal distress and gloomy business cycle conditions, it will be very difficult for the UPA to make ends meet. Going forward, we will need to see a sea change when compared with the easy spending habits of the last five years. Prudence requires expenditure cuts for coming years. The focus of government should become one of getting more bang for the buck, of extracting the maximal public goods outcomes in return for spending less. The age of spending more is over; the game will be to work smarter, while spending less.

III Core public goods

Core public goods are international relations, defence, police and judiciary. These are the foundations of civilised existence. They are pure public goods in that everyone benefits when these are done properly. When law and order conditions are good, a new born child benefits from these without imposing any new cost upon the country.

Whether it is the 26/11 attacks, or the safety of CEOs in Noida, or the safety of women in Bangalore, or naxalites operating in 100 districts: law and order is the pre-requisite for the market economy. Modern economic growth cannot take place until law and order is established. In similar fashion, contract enforcement through courts is a pre-requisite for a market economy. A country where millions of cases are stuck in court, and the number of cases that are pending grows every year, is clearly not one which is setting up the right foundations for modern economic growth.

For too many decades, governments in India have emphasised adventures of setting up government schemes that benefit narrow sections of society, at the cost of focus on core public goods that benefit everyone. It is time to question this shift in focus and reverse it.

IV Infrastructure

The importance of transportation and communication is now well accepted. Good infrastructure creates the possibility of individuals and firms in remote parts of India plugging into globalisation and thus deriving its full benefits.

In recent years, the UPA fared badly on these issues. A fresh start needs to be made on setting up competent and un-corrupt teams which will attack the problems of NHAI, the Bombay-Delhi Freight Corridor, spectrum allocation in telecom and 3G telephony, broadband connectivity where India is now one of the weakest countries in the world, electricity and urban infrastructure.

V Education

India's young demographics makes education one of the most important issues in public policy. In recent years, the UPA failed to make progress on either elementary education or higher education. In higher education, the most important issue is to remove entry barriers that have been thrown up by the State. New universities - either setup by the domestic private sector or by foreign universities - should be welcomed as has been done by China. This entry will end the scarcity of seats. Over time, some universities will build up reputational capital, a process which can be aided by government rules favouring transparency.

Non-government universities such as the Indian School of Business (ISB) are particularly important insofar as they bring in new management principles. It is striking to see that ISB is now one of the top ranked management programs of the world, a privilege which has not accrued to the public sector IIMs. This suggests that there is a lot of knowledge about how to run universities which is not, at present, easily found in India. New management teams building and running universities will help bring this knowledge into the country, which could (in the future) help transform the IITs and IIMs also into top-ranked institutions by global standards.

With elementary education, the government has spent a lot of money building schools and hiring teachers. But as the data produced by Pratham shows, the children going to these schools are learning precious little.

Parents in India choose between free government schools and unfree private schools. Yet, roughly half of the children in India go to private schools. Public resources are being unfairly focused on public schools even though half of parents are spurning them. A more fair arrangement would be to place public resources in the hands of parents, through scholarships. Parents would then choose whether their children go to a public school or a private school using this money. Scholarships given out by the government would empower poor parents who would then be able to choose the school which is in the best interests of their children. The loyalty of the government needs to shift away from funding and growing public schools, to supporting goals of voters about the education of their children.

VI Subsidies

Fertiliser and oil subsidies torpedoed public finance in recent years. The bulk of the fiscal pain that the UPA will suffer in its second term will have been caused by these problems. This fiscal risk must be blocked for future years. This requires ending the existing fertiliser and oil subsidies, and replacing them by a voucher system targeting BPL families. As an example, each BPL family would get a voucher enabling purchase of 10 litres of kerosene at a 33% discount to market price. Once this is in place, all government involvement in the market price of fertilisers or petroleum products can be ended, thus derisking the exchequer.

This is critically related to institutional infrastructure for identifying BPL families and delivering benefits to them. This requires setting up an electronic system of citizen identity. The ultimate benefits of this are enormous. As an example, using 1% of GDP or Rs.55,000 crore, it is possible to deliver Rs.2000 per family to the poorest decile of India. Once this is done, the problem of poverty would have been directly addressed, far more effectively than is done by the myriad ineffective government programs found today.

Back up to Ajay Shah's 2009 media page

Back up to Ajay Shah's home page