What should monetary policy do now?

Business Standard, 18 November 2019

The recent rise in headline inflation

From the viewpoint of the accountability of RBI to Parliament and the public, it makes sense to focus on year-on-year changes of CPI inflation. This is comprehensible for a non-technical audience.

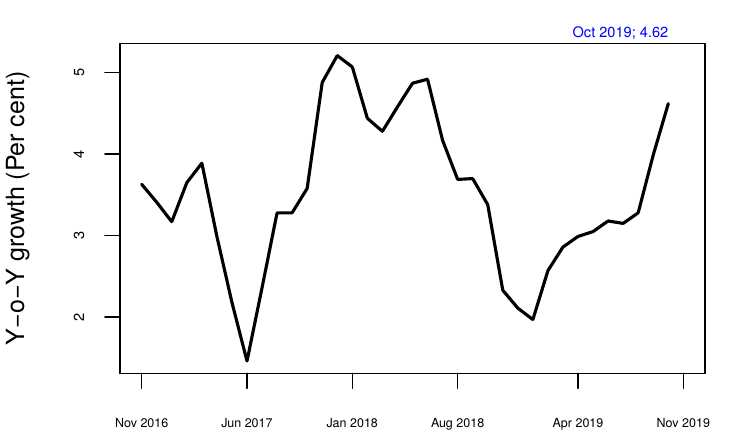

Figure 1: Headline inflation

i.e. year-on-year percentage change in CPI

This `headline inflation' has accelerated from the bottom of 1.97% in January 2019 to 4.62% in October 2019 (see Figure 1). In October 2019, this went above the inflation target of 4%, though it must be noted that RBI is required to hold headline inflation in the range from 2 to 6 per cent.

Some people are concerned that inflation has accelerated and there may be a case for rate hikes by RBI. It is important to observe that when headline inflation dropped to 1.97% for one month, this was outside the targeted range which runs from 2 to 6 per cent. When the inflation target is 4%, we should be happy that we have stepped away from breaching the targeted range (1.97%) to being back near the target (3.99% in September and 4.62% in October).

Inflationary pressures right now, as opposed to the last 1 year

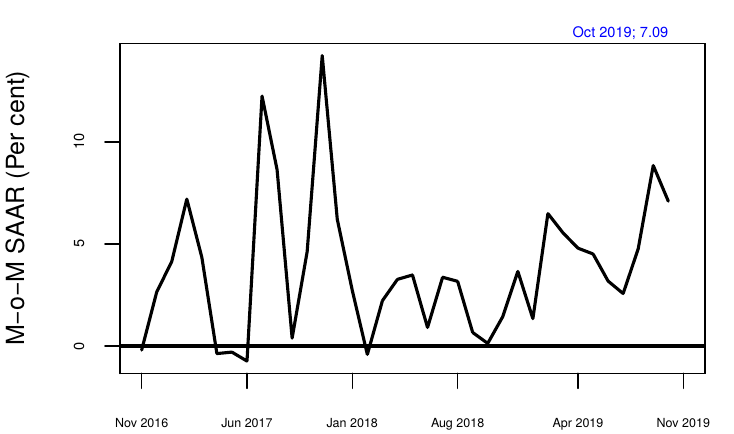

Looking beyond the black box accountability, we must switch from headline inflation to month-on-month changes, computed using seasonally adjusted data (see Figure 2). Seasonal adjustment helps us look beyond practical problems like the Kharif harvest and Diwali demand; we get to see the underlying reality after these ephemera have been removed from the data. Each value of year-on-year inflation is the average of the latest 12 values of month-on-month inflation.

Perusing the latest value of the year-on-year inflation shows us what was going on in the economy in the past one year. Looking at month-on-month inflation shows what is going on in the economy right now.

Figure 2: Month-on-month inflation

i.e. annualised month-on-month changes of seasonally adjusted CPI

Month-on-month inflation peaked at 8.84% in September and actually declined to 7.09% in October.

As Figure 2 shows, a value of 7.09% for one month is not an unusual value in the month-on-month inflation experience. In the past, individual months have seen bigger values such as 10 per cent or worse, while the overall performance of headline inflation (the 12 month average) was under control, i.e. within the range from 2 to 6 per cent.

The task of the MPC

The task of the MPC is not to respond to individual data readings. It must look deeper, at the underlying economic conditions. Monetary policy is hard because there is a lag between the move by the MPC and its impact upon the economy. Every MPC has to peer into the future, have a sense of the forces at play, and anticipate how inflation is going to shape up over a year or two.

When we look back at the performance of the MPC, it is easy to know when the MPC got it right versus when the MPC got it wrong, by looking at inflation outcomes about one to two years after the decision. As an example, the Indian MPC had two episodes in Figure 1 where inflation was at the bottom end of the range: this shows that a year or two prior to these events, monetary policy was too tight.

When we look at the economic situation today, particularly when we look beyond the GDP data, we are not in buoyant business cycle conditions. It is unlikely that there will be a resurgence of utilisation of capacity, and tightness in the labour market, which can kick off inflation. Hence, our view of inflation at future dates (of about 1 to 2 years into the future) should be relatively benign.

Low interest rates that impact upon the economy

In fact, our problem today is not that the policy rate is too high. Our problem is that the policy rate has not filtered through into most of the economy. Under normal conditions, the Indian Bond-Currency-Derivatives Nexus works poorly, which gives a weak monetary policy transmission. On top of this, right now, many financial firms are impaired; they are focused on their own survival and not on business opportunities. Lenders have pulled back from many sound borrowers. Under these conditions, the reality of access to credit and the price of credit, for a large number of people in the economy, is very different from the picture seen in the 91 day treasury bill rate (which is the de facto indicator of monetary policy).

At the same time, the solution does not lie in government fiat, in orders to financial firms to change interest rates in certain ways. We have to look deeper. There are reasons why the financial firms are behaving as they are. What is required is deep knowledge about financial sector policy, and financial reforms that go to the root cause of the problems in the financial system.

As an example, administered interest rates are an important problem. When inflation is at 4%, the interest rate of 8 to 9 per cent for EPF or PPF works out to 4 to 5 per cent in real terms. In the past, the real rate of return for EPF or PPF was about 1 per cent. There is a need to bring down the EPF / PPF rate to about 5 per cent in nominal terms, in this new environment, so as to avoid the distortions associated with these wrong prices.

Three years and counting

Some people think that given the difficulties in the economy, it is time to abandon the inflation target and crash the policy rate. A little institutional memory will help. We should recall the hardship of economic policy makers of the past, who had to fight with high inflation. Of the many problems that we see in India today, it is a relief that inflation surges are not one of them. When the full institutional power of the RBI is devoted to one thing -- delivering headline inflation of about 4% -- this removes one element of uncertainty from the picture.

To earn the respect of the people in fiat money, we have to do the right thing, over and over, for long periods of time. We are now standing on about 3 years of sound money. This is not a time to rock this boat. Every year that goes by, with monetary stability, we get a deepening of the trust. We should hang in there, and we will gradually reap the gains.

Back up to Ajay Shah's 2019 media page

Back up to Ajay Shah's home page