How many national champions are required?

by Akshay Jaitly and Ajay Shah, Bloomberg Quint, 13 February 2023

A central feature of the Indian economy is the peaking of investment in about 2011. In this article, we focus on infrastructure.

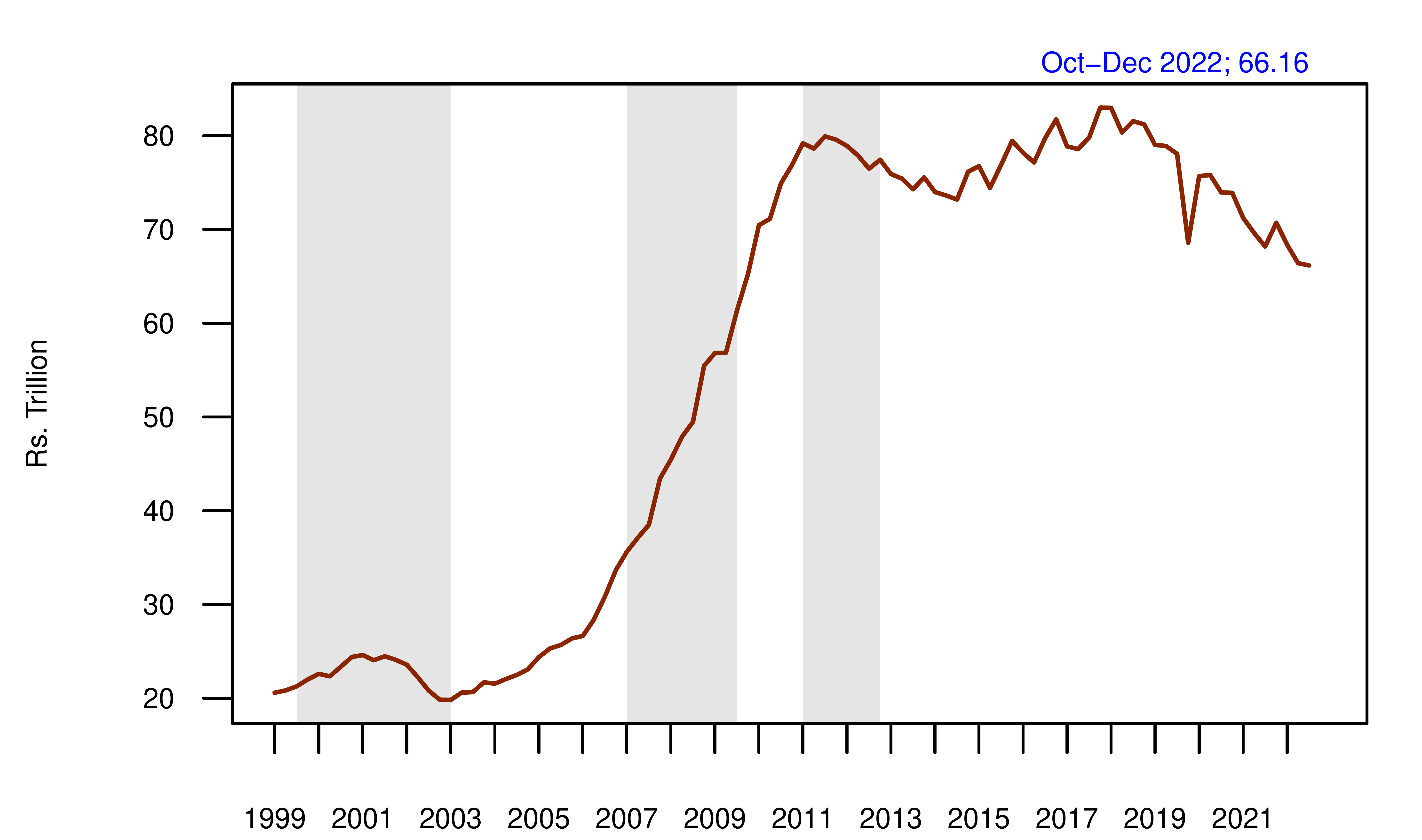

The figure shows the value of all outstanding infrastructure projects, at each point in time, as seen in the CMIE Capex database. To achieve comparability, nominal values are converted into real, into 2023 rupees. We restrict ourselves to projects that are classified as `under implementation', to avoid the vapourware announcements. We emphasise that this is not the flow of investment per year: this is the stock of the value of all projects at a point in time.

This graph shows a great surge in the period from 2003 to 2011 and a reduction by about Rs.14 trillion thereafter.

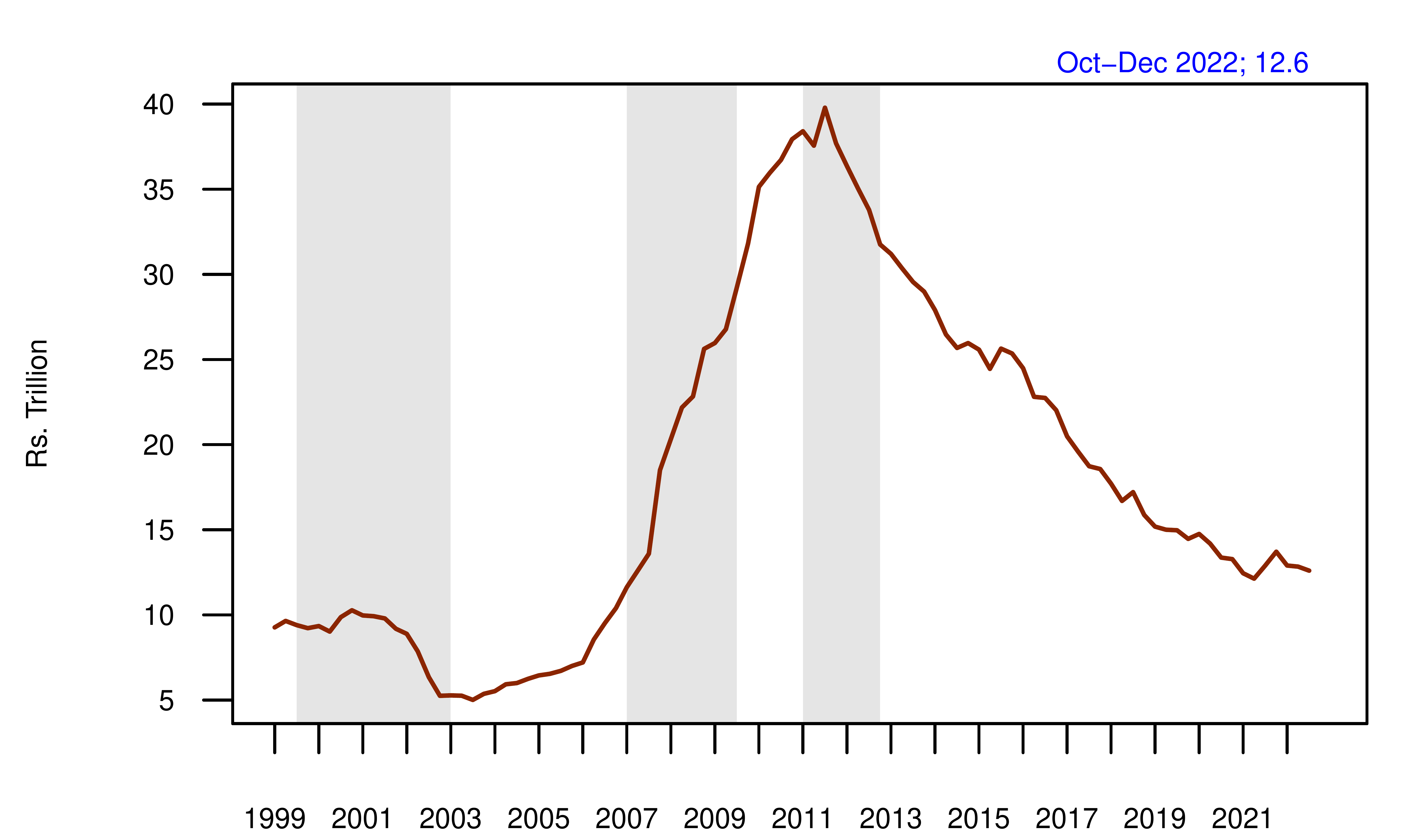

There is much interest in the `national champion' model, where a few firms are given special treatment by the government, and they proceed on investing at a large scale. In order to assess this phenomenon, we examine the history of private infrastructure projects under implementation.

Here also, we see a sharp surge from about 2003 to 2011, and difficulties in the later period, with a decline of about Rs.27 trillion. If the `national champions' model was working well, it should have counteracted the decline on a significant scale.

When we look at the magnitudes involved, we can readily understand why that did not happen. The Adani group has grown very well. A recent article by Mahesh Vyas adds up all Adani projects -- whether infrastructure or not, and whether `under implementation' or not -- and finds they add up to Rs.7.2 trillion. For the present reasoning, we will assume that all these projects will rapidly make it to `under implementation'. Thus we may estimate that one big successful organisation like the Adani group is able to run a project pipeline of about Rs.7 trillion. In this case, to get to a value for India like Rs.40 trillion (that was prevalent in 2011), we would need 6 national champions who build on the scale of Adani. To get to one doubling from 2011-2023, we'd need 12 such national champions.

Many private persons have watched the meteoric rise of national champions, with very high growth rates, and concluded that this is the solution to the investment problem. As the evidence above shows, there is a problem in the magnitudes involved. What is remarkable growth for the Adani group is not enough to generate growth for India.

And from this vantage point, let's think about the energy transition. The ballpark estimate that we should keep in mind is that to eliminate fossil fuels will require about 1000 GW of renewables capacity. Using a thumb rule of Rs.5 crore per MW of capital expenditure, this is a total cost of about Rs.50 trillion. It is hard to get this done by a few national champions.

When we look into our history, investment in the 2003-2011 period was not achieved through national champions. It was achieved through a broad-based passion for investment in the hands of myriad businessmen. While Rs.50 trillion is a lot of money for a few national champions, it is not hard to obtain this from 1000 firms where each one puts in Rs.50 billion.

Therefore, what is really required in Indian infrastructure is the establishment of the rule of law, of sound regulatory mechanisms, of predictability of contracts and policy, that will reassure private persons that they are playing a controlled game. This includes the problems of:

- Non-payment and payment delays;

- Contracts not being honoured;

- Land issues;

- Regulatory and policy risk;

- New PSUs or PSU monopolies emerging;

- Frictionless cross border movement of capital; and

- Bad behaviour by regulators and agencies

In the national champions model, a few firms feel safe knowing that they will get low friction from the Indian state, while most others have a risk perception that leads to high required rates of return. This is particularly true for foreign players, who come into India having low confidence of managing the policy environment; the only truth that would work for them is long-term predictability through the rule of law.

Establishing institutions that foster the rule of law in a market economy is a strategy that benefits everyone: the small firms, the foreign firms and also the national champions. Everyone fares better when there is more rule of law, when the state is more predictable.

While these ideas are fairly general and apply in all fields where firms face an extensive state interface (where the state is a buyer, regulator, central planner or competitor), there is a special dimension to this in the field of the electricity sector. The electricity sector has a unique problem in the form of extensive state involvement in all its aspects. In our paper The Lowest Hanging Fruit On The Coconut Tree: India's Climate Transition Through The Price System In The Power Sector, 2021, we argue that the path to bountiful private investment that is required for the energy transition lies through market-oriented reforms, where the price system and the incentives of private players -- rather than the decisions of officials -- determine electricity investments and prices.

Back up to Ajay Shah's 2023 media page

Back up to Ajay Shah's home page