Safety in the storm

Business Standard, 20 March 2023

Volatility in global financial markets has surged. There are well-known channels through which this influences cross-border capital flows. However, the exposure of the Indian economy is relatively small, as the requirement for capital import -- the gap between investment and savings -- is modest.

On February 6 this year, I wrote a column in the Business Standard, Uncertainty has declined, pointing to the fact that the volatility index (VIX) and Merrill Lynch Option Volatility Estimate (MOVE) were at low values compared with those seen in the year following February 2022, where Russian President Vladimir Putin invaded Ukraine and the US Federal Reserve started hiking rates, at which time the world looked quite uncertain. The world economy got its next air pocket last week. The VIX rose from 19 on 6/February to 26 last Saturday, and the MOVE went up from 100 to 180 in the same period.

This is, of course, a more stressed global financial environment. To add to the problems, in these difficult times, developed market (DM) central banks continue to raise rates. This combination (high DM interest rates plus high risk) is one in which all investors like to hold more DM assets. In 2022, we saw how effervescence around start-ups and initial public offerings in India, and other illiquid risky assets, became more subdued. We will see more of that in coming weeks.

But there is one respect in which the present state of the Indian economy creates a comfortable situation: This is a low scale of requirement for capital import.

The accounting identity of macroeconomics is this: The gap between domestic investment and domestic savings is the current account deficit, it is the amount of capital that's imported from overseas. Many people tend to emphasise import and export in thinking about the current account deficit. But insight into macroeconomics comes from tracing the roots of capital import as the requirement for domestic financing that's not met locally.

In this reasoning, we should keep the limitations of conventional measures in mind. Phenomena like legal and illegal gold import, import over-invoicing, and export under-invoicing are all outside the standard measure of the current account deficit. For the reasoning today, we will just focus on the foundation: the gap between investment and savings of the economy.

On the savings side, there is one main question: The fiscal stance of the consolidated Indian state. When the Indian state runs larger deficits, aggregate domestic savings come down. While changes in the deficit have been important in shaping the investment/savings gap in some years, generally, these year-on-year changes are relatively modest. The Indian state is a big supertanker, and the change seen from one year to the next tends to be limited.

The important factor that changes across time is private investment. Investment responds to animal spirits. When there is optimism all around, the magnitudes of investment that can be unleashed are very large. The benefit from having an open capital account lies in having access to financing as and when investor confidence comes together. In a fully closed economy, investment cannot exceed savings, so the moments of optimism fail to generate the bouts of investment.

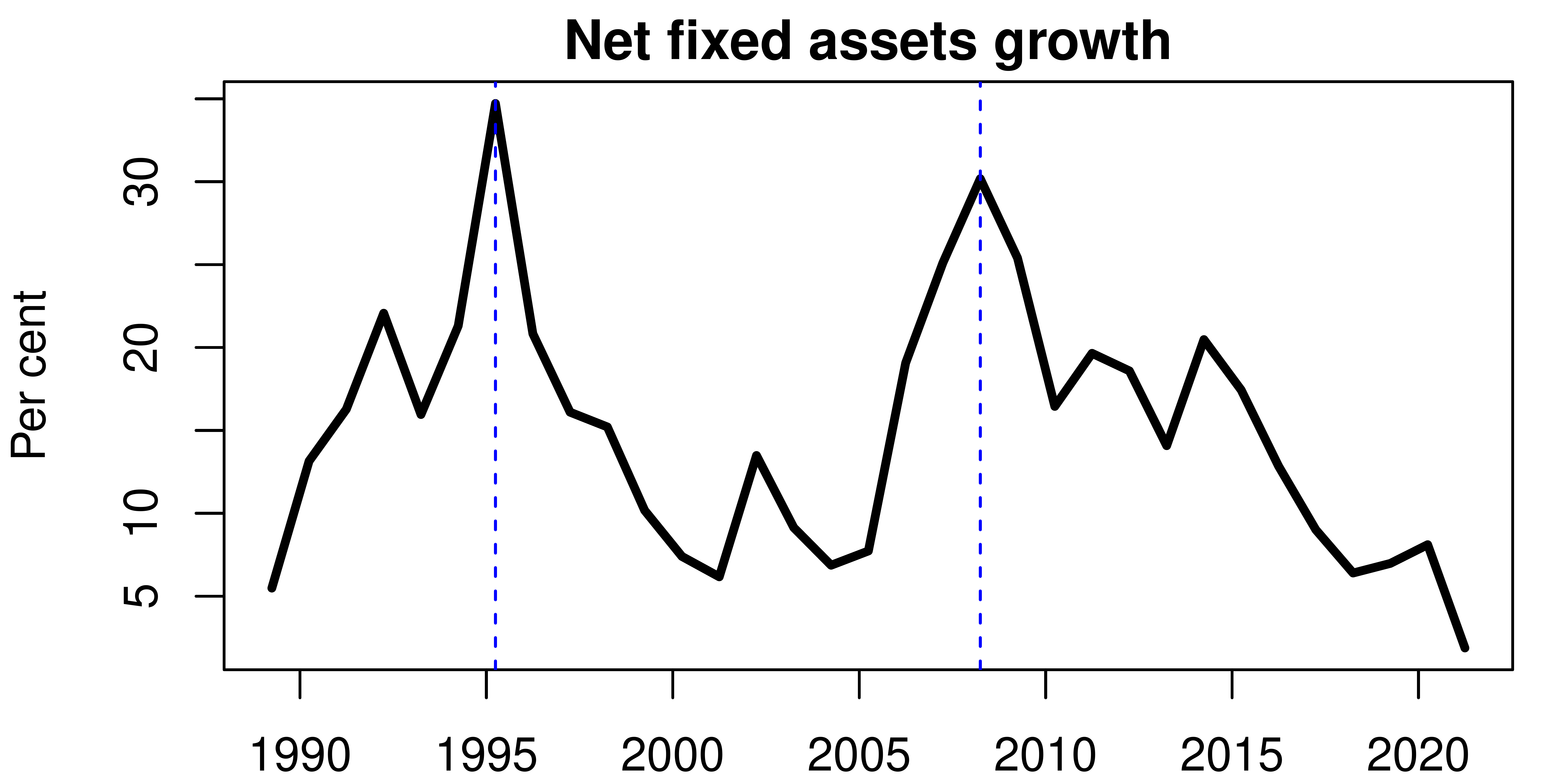

Large non-financial firms are an important group in which sound data can be obtained. The year-on-year nominal change in the net fixed assets of the full CMIE database of large non-financial firms (fusing both listed and unlisted companies) has values ranging from about 35 per cent to about 0 per cent. In the post-pandemic period, this data, and many other sources of information, show weak investment by the large non-financial firms.

The weak pace of investment within India is within reach of the supply of savings in the economy. The requirement for foreign capital inflows is hence relatively small. There was greater stress in India in the international turmoil of 2008 and 2012 because the requirement for capital import in those years was greater, and also because 2008 was a much bigger global crisis.

If the capital import requirement had been higher, in this more difficult environment, the market still clears and the requisite capital import comes about, to make the accounting identity work. When the global financing environment is more stressed, Indian asset prices have to drop to a point where buying them looks attractive. There are two ways in which this can happen: Either the exchange rate can act as a shock absorber and cheaper Indian assets are achieved through INR depreciation, or the authorities hold up the exchange rate and local asset prices drop to a point where they are sufficiently attractive to global investors. When there is global stress, the price of real estate in India expressed in USD has to drop, and this comes about through some combination of USD/INR adjustment and real estate price adjustment.

There is an old strand in development strategy which worries about the size of capital inflows that can be successfully obtained, which wonders whether the feasible capital import is quantity-constrained. The phrase ``sustainable current account deficit'' was also used a lot. Over the years, we have understood that these concerns are misplaced, particularly for a large country like India. The global financial system always has infinite capital. But individual asset classes can experience hiccups. We have seen episodes of mistrust of Indian government debt, episodes of mistrust of Indian start-ups, etc. The solution lies in having a large number of well-established Indian asset classes in the global investment universe. It is good to have a diversified engagement with global finance, with well-established information flows and middlemen operating in public equity, private equity, government bonds, corporate bonds, commodities, etc. Once this is done, hiccups in any one asset class do not create a problem on the macroeconomic identity as a small INR depreciation compensates by making the other asset classes more attractive.

Back up to Ajay Shah's 2023 media page

Back up to Ajay Shah's home page