Two divergent measures

Business Standard, 3 March 2025

Facts on economic policy uncertainty

In 2016, Scott R. Baker, Nicholas Bloom and Steven J. Davis developed a measure of economic policy uncertainty ("EPU") based on the analysis of words in the media. These measures have found many successful applications in the research literature. In periods where media freedom is stable, changes in these measures seem to meaningfully pick up changes in policy uncertainty.

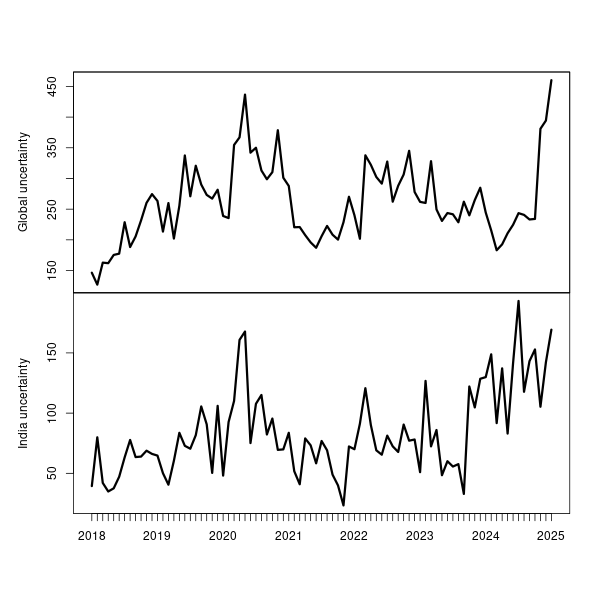

The graph superposes their measure for the world and for India. In both cases, the Covid peak is a good reference point. In the global measure, we see a sharp increase in policy uncertainty in recent months. The latest value is above the Covid peak. In India, the Covid peak was an index value of 168 (May 2020). Bigger values arose in July 2024 (index 193), January 2025 (index 169) and February 2025 (index 176).

The puzzle

There is a fascinating divergence between this view of the world and how the financial markets think. The most important measure of the global economy is the level and the forecasted volatility (the VIX) of the S&P 500. The S&P 500 is not an American equity index, it is really a globally diversified portfolio. For a sense of scale, the value of the VIX at the peak of Covid fear, in March 2020, was 66% (i.e. the forecasted annualised volatility of returns on the S&P 500 was 66%). It is at about 20% now: it shows no fear.

There are, of course, parts of the financial system which are flashing amber. Gold is a vote of no confidence in civilisation, and gold prices have gone up smartly. But there are two important measures and they see things rather differently. The EPU is saying: There is radical policy uncertainty, a bit worse than the start of the pandemic. But the S&P 500 is calm in a turbulent world. What is going on?

The US is in a constitutional crisis, with a failure of checks and balances, with the inability of the judiciary, the legislature, the electoral system, the agencies, the special counsel and the press to rein in a strongman. How immune is the world economy to American decline? When America becomes more like an EM, and with a US withdrawal from its post-1945 role in sustaining Pax Americana, does this matter for the world economy?

Three rival views

- The Trump faithful deny the impact of populism upon the success of a country. The dictionary definition of the term `populism' is: a political approach that strives to appeal to ordinary people who feel that their concerns are disregarded by established elite groups [EiE Ep42 The populist playbook]. Populism is often a winning card to play in electoral contests but is rather harmful for the working of the country. This is not just an ideological question; the academic literature knows a lot about it, we know that societies fares poorly under populist governments. A successful society requires policy frameworks and conditions of elite safety, that foster commitment and risk taking, through which wealth, science, and art are created.

- The second view is that the world has been through many a crisis before, from the missile crisis to the pandemic, and this is just one more. This optimistic view has to climb the wall of concern around the decline in American state capability, and Trump's partnership with a revisionist actor (Putin). Coping with the 2008 crisis required US levels of state capability, and winning the cold war required taking on the USSR. There has never been an American government like this in 1941-2016.

- The third view is that American decline matters for the world economy. The world that we saw from 1941 to 2016 was critically made possible by American power. American protection and support enabled global economic freedom, technological development, and globalisation. The U.S. role in the global economy was essential for India's four-fold GDP growth from 1991 to 2011. If the US had partnered with the Soviet Union, Narasimha Rao may not have green lighted the 1991 reforms, and India may not have had friendly access to a sophisticated globalisation.

Speculating about the future

The rise in the EPU, seen in the two graphs above, maps to a changed macroeconomic situation in a simple way. Increased uncertainty leads to greater caution. Firms and households will delay decisions, waiting for clarity. They will demand higher risk premia, and green light fewer projects. This simple logic is starting to show up in the data. It will hamper the demand side of the world economy in 2025.

The dismal science does offer a pathway to a a happier scenario. Trump is not checked by special counsel, the judiciary, the legislature, the agencies or the press. But he cannot control the go-slow decisions of households and firms, and the reasoning power of financial markets. Even in this golden age of Putin and MAGA propaganda piped into social media, you can twist perceptions but reality won't budge.

The bond market `can intimidate everybody'. In the UK, when Liz Truss engaged in erratic policies, the bond market responded sharply, and she had to resign. In 2020, when Trump tried to downplay the pandemic, the S&P 500 dropped 30% in a few weeks, and that kicked his administration into responding to the pandemic. The US has $37 trillion in debt, which requires continuously going back to bond market asking for capital. The financial markets, and only the financial markets, have the ability to check-and-balance Trump and his coterie.

We have two good measures: the S&P 500 level and volatility (which is comfortable) and the EPU (which is hyperventilating). We should not disregard either. Perhaps they can be reconciled as follows. In coming months, some of the MAGA faithful and some of the `what me worry?' investors will start understanding the full scale of the damage to America and to the world. Traditional America-centric habits around credit ratings, safe havens, etc. will change gradually. More conflict will break out, more people will read foreign policy and war, and understand the criticality of Ukraine. Market discipline will then impinge upon Trump and the MAGA world, and we hope, atleast partly kick them into shape. Be you ever so high, the markets are always above you.

Back up to the media page for the year

Back up to Ajay Shah's home page