The cleansing of downturns

Economic Times, 10 October 2013

Downturns are painful but essential cleansing of capitalism. Our last experience with a full blown downturn (1996-97 to 2001-02) gives us insights into how things might play out.

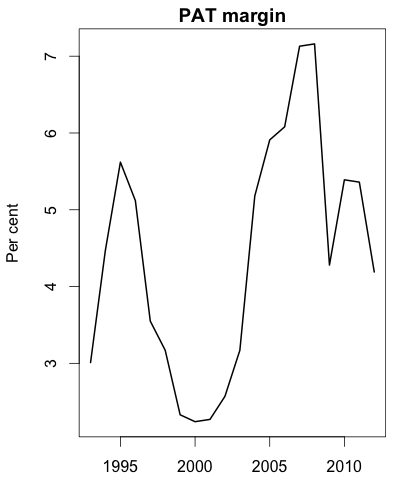

In the early 1990s, with the great investment

boom, we got buoyant business cycle conditions in India. In the CMIE

database, in 1994-95 and 1995-96, profit after tax was over 5% of

sales for non-financial firms (see graph alongside). From 1996-97

onwards, things worsened. The PAT margin went all the way down to

2.24% in 1999-2000. From the peak (5.62%) to the trough (2.24%) was a

ratio of two and a half times. This had very bad implications for

stock prices.

In the early 1990s, with the great investment

boom, we got buoyant business cycle conditions in India. In the CMIE

database, in 1994-95 and 1995-96, profit after tax was over 5% of

sales for non-financial firms (see graph alongside). From 1996-97

onwards, things worsened. The PAT margin went all the way down to

2.24% in 1999-2000. From the peak (5.62%) to the trough (2.24%) was a

ratio of two and a half times. This had very bad implications for

stock prices.

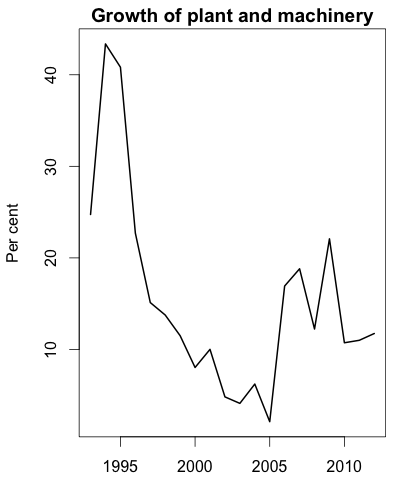

Faced with weak profitability, firms pulled

back on investment. The year-on-year growth of plant and machinery of

non-financial firms, which was 40.83% in 1994-95, slumped to 4.11% in

2002-03 (see graph alongside). It is interesting to see that while the

PAT margin bottomed out in 1999-2000, investment bottomed out three

years later.

Faced with weak profitability, firms pulled

back on investment. The year-on-year growth of plant and machinery of

non-financial firms, which was 40.83% in 1994-95, slumped to 4.11% in

2002-03 (see graph alongside). It is interesting to see that while the

PAT margin bottomed out in 1999-2000, investment bottomed out three

years later.

Along this way, we got a great cleansing of Indian firms. Every business cycle expansion brings with it the over-optimists and the charlatans. Thousands of firms went bankrupt and we got a great wave of NPAs (which generated quite a crisis for banks and DFIs). The death of firms freed up capital and labour. The price of real estate and labour went down, the exchange rate depreciated, and production in India became more competitive.

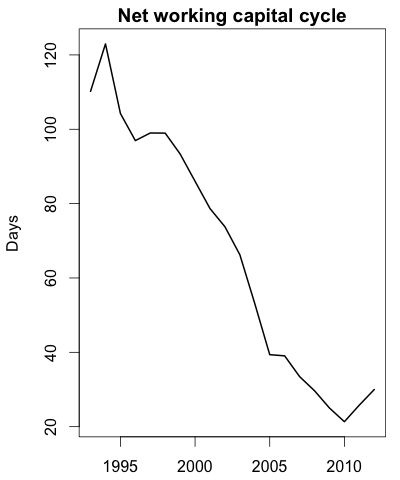

The survivors were those who hunkered down and became

smarter. Productivity improved sharply. As an example, the net working

capital cycle (see graph alongside) went from 97 days in 1995-96 (the

last happy year) to 53 days in 2003-04. We saw a new tone of flesh of

Indian capitalism. By the early 2000s, firms were more

internationalised, had better technology, had done a first-cut

computerisation of all their operations, had sharply reduced the

headcount required per unit of output. The hucksters and charlatans,

who occupied so much of the headlines of the early 1990s, were largely

shaken out.

The survivors were those who hunkered down and became

smarter. Productivity improved sharply. As an example, the net working

capital cycle (see graph alongside) went from 97 days in 1995-96 (the

last happy year) to 53 days in 2003-04. We saw a new tone of flesh of

Indian capitalism. By the early 2000s, firms were more

internationalised, had better technology, had done a first-cut

computerisation of all their operations, had sharply reduced the

headcount required per unit of output. The hucksters and charlatans,

who occupied so much of the headlines of the early 1990s, were largely

shaken out.

Hard times also brought out better behaviour from government. There was frugality in spending; the transformation of the equity market and the telecom sector; the New Pension System; NHAI and substantial improvements in indirect taxation.

This hard work in the private and public sectors laid the foundations of the greatest business cycle expansion of India's entire history. The net profit margin grew from 3.17% in 2002-03 to 7.16% in 2007-08. The peak net profit margin in 2007-08 (7.16%) was much higher the previous peak (5.62%). The stock market boomed, because the P/E ratio went up when people started getting used to high growth, and because the earnings were growing very fast.

At first, firms got capacity utilisation back up, and firms which had been burned with immense difficulties were cautious in re-starting investment. Many people were quite skeptical about `the India story' and wondered if there were good growth opportunities here. All the way till 2004-05, asset growth was only 2.11%. The investment boom restarted only in 2005-06 and lasted till 2008-09.

From 2009-10 to 2012-13, we have now seen four hard years. Asset growth has been just slightly above 10%. In 2011-12, the PAT margin was 4.19%. How might things play out? While there is a great deal of angst about the downturn, the previous cycle teaches us a few things about how things may play out, and the good side of business cycle fluctuations.

Recessions uncover what auditors cannot. Bad times shake out the hucksters and charlatans. Their exit is good for sound firms at numerous levels. The exit of weak firms improves profitability of the survivors. As an example, when Kingfisher went under, other airlines became more profitable. Less visible, but equally important, are the impacts upon the labour and capital markets. Fewer firms hiring means lower wages, less competition for talent, and greater ability to construct stable teams. Commercial real estate prices have started dropping all over the country, which improves the viability of survivors. Finally, fewer firms asking for debt and equity capital improves availability of capital for the survivors.

Every firm today is in a grim battle to survive and flourish. This requires digging in, reshaping the organisation, disrupting existing power centres within each firm, and supporting reinvention. This is the time for CEOs to tear down complacent structures within the firm and fight for the interests of the customer. In good times, top managers take care of themselves. Bad times force them to serve customers.

Downturns are painful. At the same time, they do a lot of good. There is more energy in reforms. Incompetent and evil firms are killed, labour and real estate become cheaper, productivity is higher. The survivors will be poised to surge in the next boom. This process of creative destruction is the eternal cycle of the market economy.

Back up to Ajay Shah's 2013 media page

Back up to Ajay Shah's home page