New hope in private investment?

Business Standard, 20 September 2021

Private investment is the most important source of economic and cultural dynamism in a country This has been in a long winter from 2011 onwards. One part of this story is the sharp decline in private participation in infrastructure, and the enhanced role of the state in infrastructure. There is a small recovery in recent months.

The problem of private investment

Most GDP and most jobs are made by the private sector. The greatness of a country is about the freedom, energy, creativity and optimism of private persons. When private firms build fixed assets, this generates a long-term stream of output, and a long-term stream of wage payments. An investment project plays out for a short period of time, and then kicks off output and wages for a sustained period.

India got good growth in the 1991-2011 period, and after that private investment has faltered. One way to measure private investment is the year-on-year growth of net fixed assets as seen in the (annual) balance sheets of non-financial firms. Another way to see this is through the CMIE Capex database, which chronicles investment projects. Expressed in 2021 rupees, the peak value of the stock of private `under implementation' projects was near Rs.90 trillion in 2011/12. There has been a decline in the following years of about Rs.50 trillion. On average, this is a decline of Rs.5 trillion or about $70B per year.

This is the most important phenomenon of Indian economics of the last decade. In every country, the construction of the state shapes the freedom and optimism of private people, which in turn determines the willingness of people to commit, to invest, to build organisations. Vijay Kelkar and I wrote a book-length treatment on these questions, In service of the republic: The art and science of economic policy, Penguin Allen Lane, November 2019.

Does the technology boom suffice?

There is much joy about the success of technology companies in the last two years. But we must temper our excitement, owing to the magnitudes involved. Moving the needle of this large economy is not easy. In a GDP of about $3 trillion per year, 1% of GDP is $30 billion per year. Similarly a million new jobs is not large when compared with the overall workforce of 400 million people and 800 million non-employed people. Information technology is India's greatest industry, and the source of a lot of human interest stories, but the developments there are not large enough to offset the underlying problems of the economy.

The problem of private infrastructure investment

One part of the problem is infrastructure. Private `under implementation' infrastructure projects (expressed in 2021 rupees) peaked in 2011/12 at about Rs.36 trillion and now stand at Rs.10 trillion. A decline of Rs.26 trillion in private projects `under implementation' is on account of the problems of infrastructure. There is thus a roughly 50-50 split in the decline: about half of the decline in private sector investment has come about in infrastructure and the other half in everything else.

When we look more carefully at the field of infrastructure, for some time, expansion in government infrastructure projects compensated. From 2011 to 2018, the overall `under implementation' infrastructure projects remained at about Rs.70 trillion, with the decline in private being offset by an increase in government. But there are inevitably difficulties in the strategy of emphasising government infrastructure investment. Fiscal capacity and project management in government is quite limited, so the state-led strategy has limited headroom. From 2018 onwards, the stock of government `under implementation' projects has declined in real terms by Rs.7 trillion. As a consequence, the total infrastructure projects `under implementation' declined from Rs.72 trillion in 2018 to Rs.63 trillion today. This change in infrastructure investment from 2018 onwards, and its consequences for the demand side of the economy, have not been widely recognised.

Recent developments

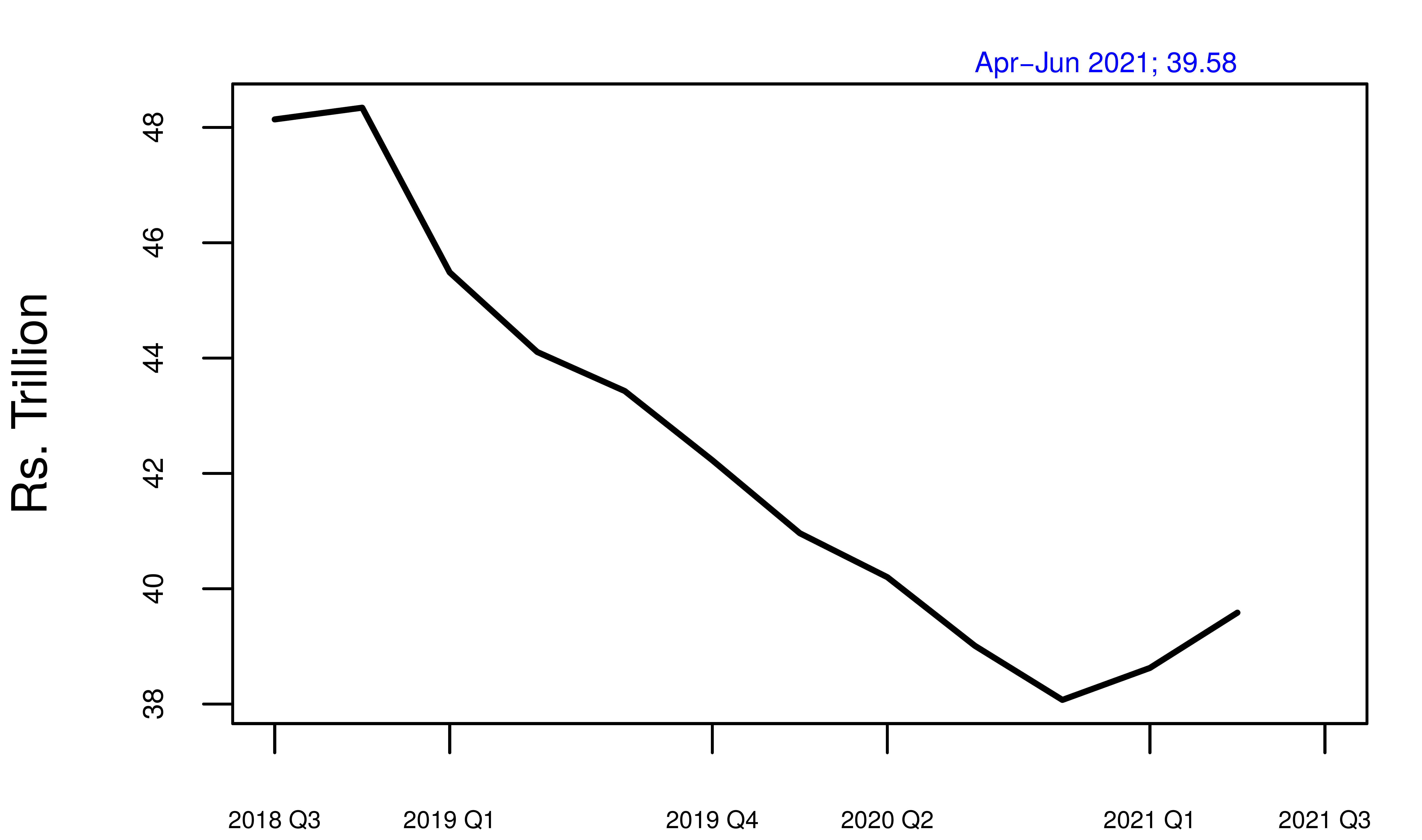

Figure: The latest three years for private projects `under implementation', measured in 2021 rupeees.

The graph above shows that from a bottom of about Rs.38 trillion, there has been a recovery to Rs.39.58 trillion in the Apr-Jun 2021 quarter. Is this just a flash in the pan? There are three elements at work.

- In the pandemic, some firms faced radical uncertainty, had little management bandwidth left after dousing numerous fires, and had put investment activities on hold. By 2021, uncertainty had declined and fire-fighting had declined. These firms are going back to normalcy in investment.

- Vaccination in developed countries took off, developed countries used fiscal policy to restart their economies on a gigantic scale, and an export boom from India started. This was assisted by nationalism in China, which led many in the world to shift business to India. Many Indian firms shifted resources to emphasise export- or export-adjacent activities, and have harnessed the export boom. Through these developments, many firms in the export sector are investing.

- Finally, the structure of consumption in the pandemic shifted. Some industries did badly (e.g. commercial real estate) but some industries did well (e.g. broadband telecom). Firms in the right industries saw high growth and are back to investing.

As of yet, the observed change of about Rs.2 trillion is not large in absolute terms. The recent data will be important if they are a turning point, as opposed to the long history of declines. The next data point, for Jul-Aug-Sep 2021, which will be released on 1 October is an important fact that we should watch for. Potentially by that time the magnitudes may start adding up. A rise of Rs.5 trillion (to Rs.43 trillion) would offset the decline of the average year of the last decade.

A recovery in private investment yields greater demand for industries such as finance, consulting, research, construction, and capital goods. All these industries have had a difficult time in the last decade, and could witness a change in their fortunes.

Back up to Ajay Shah's 2021 media page

Back up to Ajay Shah's home page