Focus on CPI inflation

Business Standard, 18 April 2022

At the heart of the monetary policy is the choice between controlling inflation versus controlling the exchange rate. In previous decades, there was an argument that by stabilising the exchange rate, we stabilise domestic prices. Inflation targeting was nevertheless chosen, because of other aspects of the tradeoff, particularly for a continental economy like India. Now that world inflation has been destabilised, even if the USD/INR is unmoving, this only means that we will import global inflation into India. The tradeoffs have shifted in favour of less exchange rate management.

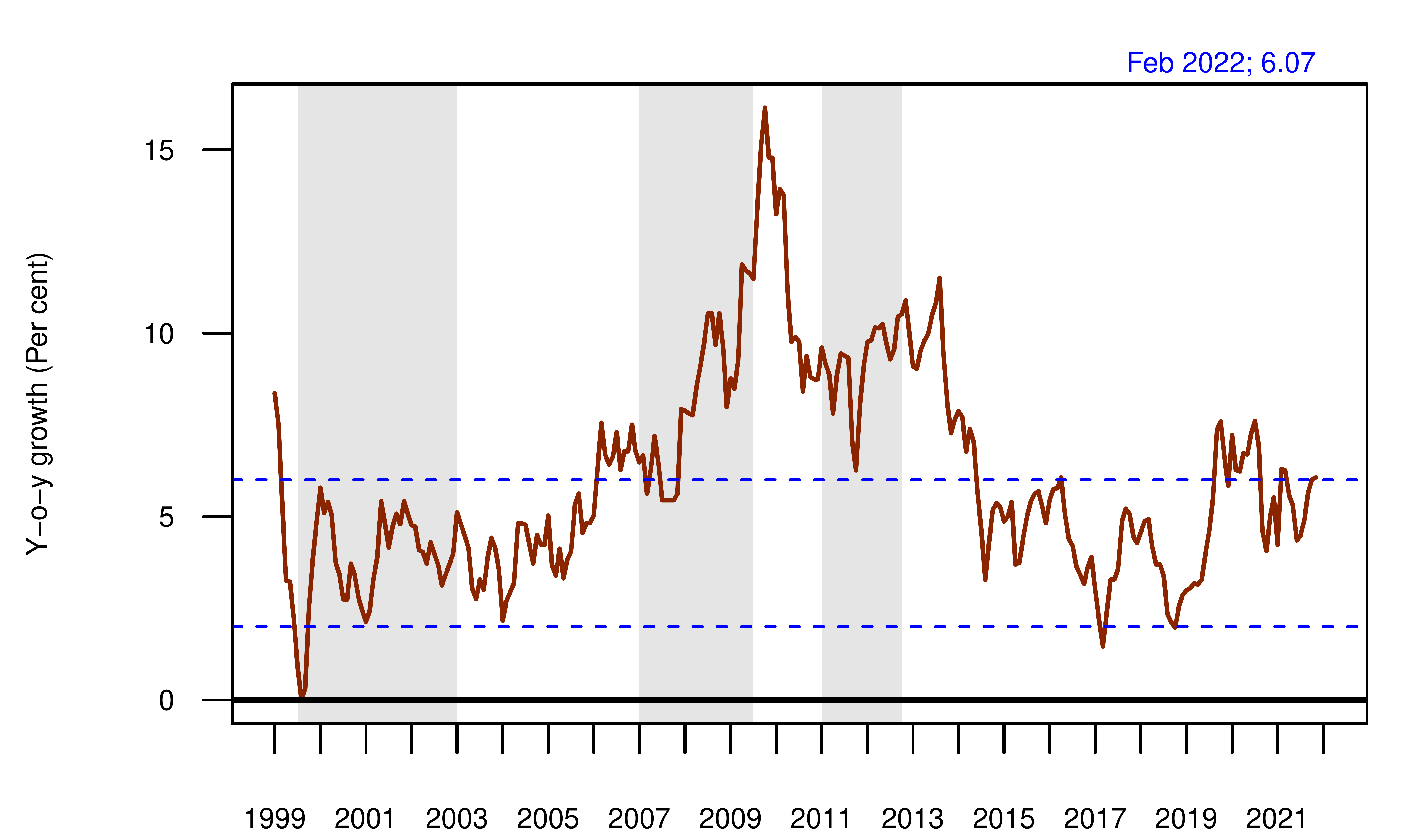

Figure: Headline inflation (i.e. year-on-year CPI inflation) in India

Inflation in India took off in the 1970s and has repeatedly flared up ever since. In the late 1990s and early 2000s, there was a period of price stability in India. This was also a period of intensive exchange rate management, a period where the exchange rate was largely determined by the government and not through market forces. There is a connection between the price stability and the exchange rate management of this period.

The two key phrases of this field are import parity pricing and tradeables inflation. Many domestic prices are formed out of import parity pricing. For example, there is no Indian price of steel: It is just the London Metals Exchange price of steel multiplied by the USD/INR exchange rate. This is because, with steel, goods arbitrage is reasonably frictionless. If the Indian price is too low, someone will turn a profit by purchasing steel in India and shipping it out. If the Indian price is too high, someone will make a profit by importing steel into India.

A commodity price is controlled by import parity pricing when goods arbitrage is merely feasible. A little bit of goods arbitrage happens from time to time. For the rest, there needs to be no significant import/export activity: There only needs to be the possibility of this, without barriers like customs duties or poor infrastructure. The products where goods arbitrage is feasible are called tradeables.

For all the products in India where there is a fair degree of import parity pricing, the Indian price is not affected by monetary policy; it is just the exchange rate multiplied by the world price. All developed economies conquered inflation by establishing accountable central banks with inflation targets, and therefore there was a period from 1983 to 2021, where global inflation was low. The price rise of steel in USD was relatively modest, and when multiplied by a stable value for the USD/INR, we got a relatively modest price rise of steel in INR.

In this period, there was a special justification for exchange rate management: By stabilising the USD/INR rate, we in India could import low tradeables inflation into India. By tying the rupee to the USD as a nominal anchor, we would also foster price stability in India.

This argument was correct in the 1983-2021 period. And hence, for the period where RBI was doing exchange rate management, there was this indirect benefit of stabilising the prices of tradeables. The extent to which this is the case is higher in a small country like Singapore (where tradeables matter more). In India, which is a continental economy, many prices are not made through goods arbitrage, and low tradeables inflation is less valuable.

To be sure, this monetary policy strategy is not optimal. Exchange rate management ultimately harms growth and stability. A great inflation began in India in 2006, there was a currency defence in 2013. The intellectual consensus shifted, inflation targeting came about in February 2015.

While there is a de jure inflation target, the facts on the ground diverge. It is fair to say that from 2015, inflation became more important to the Reserve Bank of India (RBI), but RBI watchers remain in the game of identifying the extent to which, on any given day, it is pursuing inflation, or low-cost borrowing for the government, or exchange rate management.

One gain from exchange rate management -- stabilising the prices of tradeables in India -- no longer holds. In 2021 and 2022, developed market (DM) central banks have dropped the ball on inflation. While all of them have a target of 2 per cent Consumer Price Index (CPI) inflation, the present inflation rate is much higher, e.g. in the US it is 8.5 per cent.

This changes the tradeoffs faced by policymakers in India. If the tradeables basket expressed in USD has inflation of 6 per cent, and if USD/INR is unchanged, then this imports 6 per cent inflation (for the tradeables basket) into India.

I have no doubt that DM central banks will wrestle inflation back to 2 per cent. Whether it is the US Fed, or the European Central Bank, or the Bank of England : all of them have the full intellectual clarity of inflation targeting. They are not confused about the purpose of a central bank, or the role that a central bank plays in society. But getting inflation back down will take time. It is hard to see the CPI in the US achieving the target of 2 per cent before 2024. For 2022 and 2023, an uncomfortable extent of tradeables inflation is likely.

Exchange rate management is full of pitfalls, the enumeration of which is not the task of this article. But at a time when global inflation was under control, exchange rate management had one redeeming feature: Stabilising the USD/INR meant that we were importing low tradeables inflation into India. Even after taking this into account, exchange rate management worked badly, and the failures of monetary policy of the 2006-2015 period led to the new regime of inflation targeting.

This one redeeming feature is absent in 2022 and 2023. Stabilising USD/INR will merely bring a high level of tradeables inflation into India. This further tips the argument in favour of inflation as the prime task of the RBI, and not exchange rate management. The best thing that RBI can do for India is to deliver a predictable 4 per cent CPI inflation for decades on end. This creates conditions of macroeconomic stability, within which private persons can plan their lives and invest.

Back up to Ajay Shah's 2022 media page

Back up to Ajay Shah's home page