From domestic to global asset pricing

Business Standard, 8 January 2024

The only free lunch in all economics is portfolio diversification. We reduce risk when a portfolio goes from one firm to multiple firms within an industry. We reduce risk by holding assets in multiple industries. And finally, we get a good dollop of risk reduction by holding assets in multiple countries. The safest equity portfolio is one spread across a dozen mature liberal democracies.

The correlation between Nifty and the S&P 500

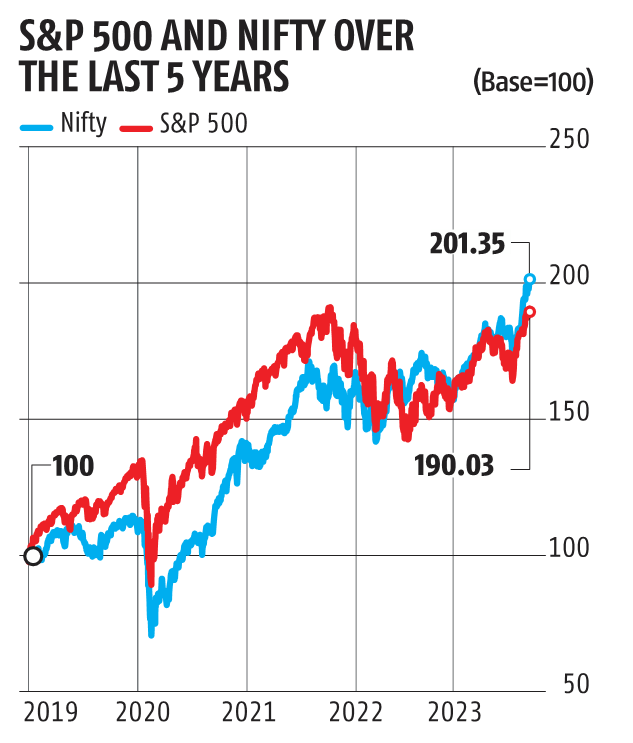

In the graph, we have juxtaposed the level of the S&P 500 and the Nifty, over the last five years. It is remarkable, how much they move together. Further, the S&P 500 is expressed in USD. When the 101.35% returns on Nifty is adjusted for the 16% depreciation of the USD/INR rate, the end points of the two indexes are rather alike.

In the olden days, Nifty was less correlated with the S&P 500. One explanation is real sector integration: The Nifty firms became more internationalised through imports, exports, outbound FDI and the domestic presence of their global rivals. The other dimension is financial integration, which comes about through the rising share of overseas equity and debt investors who think about asset pricing in an internationalised way.

Two pools of stock market valuations

All firms are in the journey of internationalisation on the real sector. But financial sector integration is special in that only this generates a permanent change in the stock market valuation. Every firm starts out with a valuation within India, and might gradually graduate into international asset pricing.

Indian firms achieve a higher valuation under international asset pricing. The superior P/E ratio or P/B ratio associated with international asset pricing is synonymous with a lower cost of equity capital. These firms are then more like global firms, who have a lower discount rate, who have a more long term view, are able to undertake more investment projects and grow faster.

The Indian equity market is composed of two ponds. There is one pond with the firms that face domestic asset pricing. It is their aspiration to achieve financial internationalisation, to graduate into the other pond, where international asset pricing gives a higher valuation i.e. a lower cost of equity capital.

Implications for foreign investors

For a foreign investor, many decades ago, there was an easy story of achieving global diversification using index funds. The methodology of Nifty was designed so as to be conducive to implement index funds, and then these index funds could slip readily into global portfolios seeking international diversification.

In recent decades, these top 50 firms have become significantly internationalised with both real sector integration and financial integration. Correlations into the global economy have risen. The easy pathway for foreign investors -- invest in India using Nifty index funds -- is now less useful.

Global investors now need to look behind the 50 members of Nifty, into the more messy universe of stocks that lies behind. The Indian equity market has limited liquidity, particularly outside the Nifty firms, so it is not easy finding a diversified group of less correlated but adequately liquid securities. Foreign investors can benefit from private equity and venture capital funds, to access the unlisted space, where less correlated assets lie.

Implications for Indian investors

A good foundational portfolio for the Indian investor is a dozen index funds in advanced democracies. As Nifty is now more correlated with global indexes, the role for Nifty in the optimal portfolio is diminished. The puzzle for most Indian investors is then similar to the puzzle for foreign investors: of finding the goldilocks zone of Indian indexes which are relatively uncorrelated with the globe, but pass the tests of the Nifty construction methodology, i.e. there is enough stock market liquidity to support efficient index fund construction (low total expenses and a low tracking error).

There are high returns on assets when they undergo the transition from domestic asset pricing to international asset pricing (when a firm goes from being priced as an Indian asset to being priced as a global asset). There is an idea for portfolio strategy here: To bet on the firms where it is hoped they will go from the domestic pond to the international asset pricing pond in the coming decade.

But equally, portfolio strategists need to recognise the reduced expected returns once the transition is made. The use of one single value for the equity premium across all Indian equities is faulty.

Implications for Indian firms

Strategic thinking in Indian firms needs to play two distinct games. The first is the pursuit of real sector integration, i.e. the role of imports, exports and outbound FDI. The weakest firms get help from the government, weak firms stay domestic, good firms export and the best firms do outbound FDI. Boards should exploit this in their oversight of the management. Demanding success in exports and FDI is a good way to ensure that the management is building a genuinely strong firm.

And distinct from this is the problem of financial integration, through which a permanent gain in valuation (i.e. a reduced cost of equity capital) can be obtained. Firms generally view foreign investors showing up through the stock exchange as being out of their control. There are levers available to a firm that grow the share of global investors in its equity and debt. Strategic investor relations can shift equity and debt investors in favour of foreign investors. Listing in London or New York harnesses a superior equity market ecosystem, and increases visibility and trust in the eyes of global investors.

In real sector integration and in financial sector integration, there is a wedge between the interests of the Indian state and the interests of the Indian economy. Firms need to commit to the expenditures on advisors, lawyers and accountants to navigate the path to internationalisation.

Back up to Ajay Shah's 2024 media page

Back up to Ajay Shah's home page