Lost a shock absorber

Business Standard, 12 May 2024

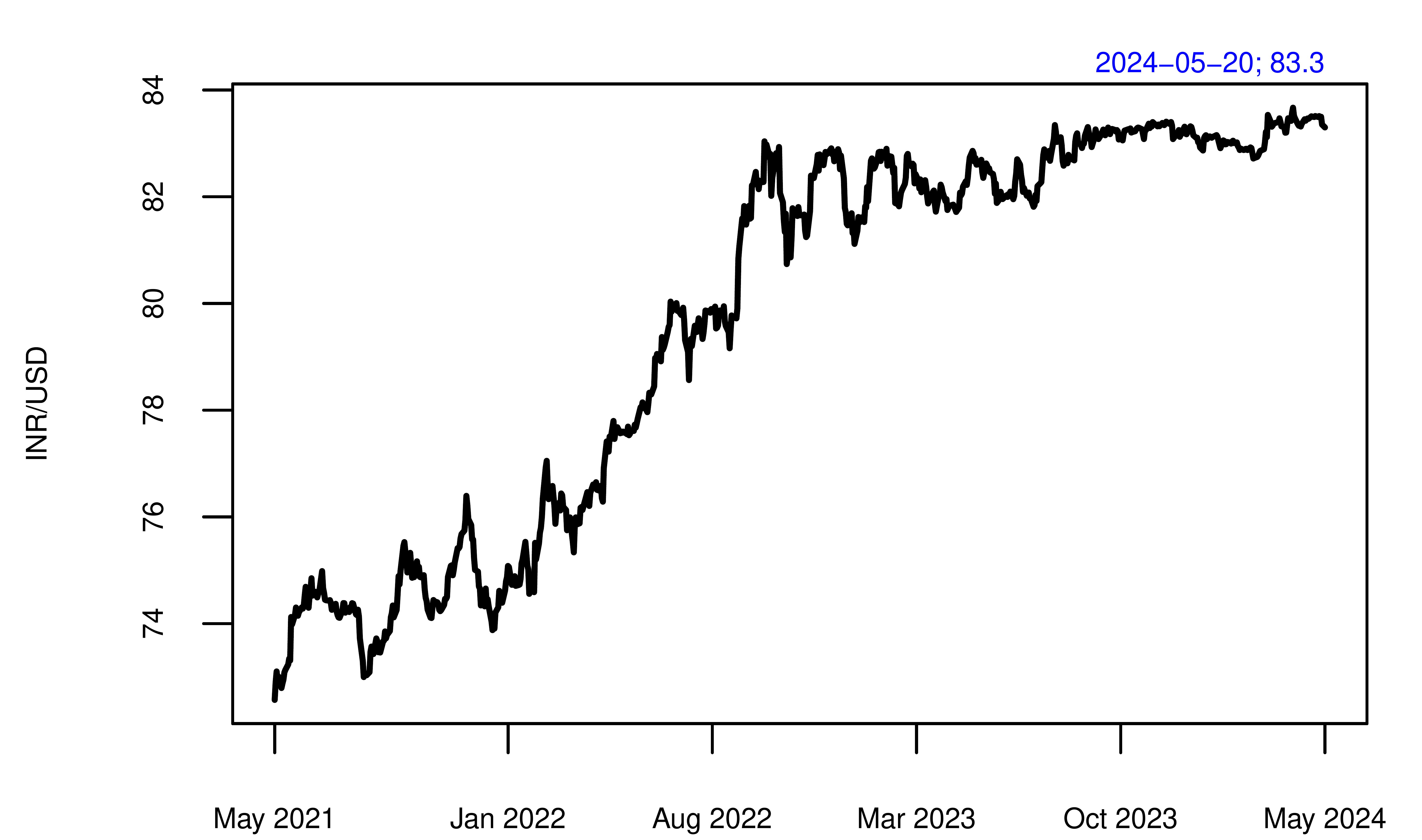

Exchange rate flexibility is a shock absorber. When there are external or internal shocks, part of the load is borne by a flexible exchange rate. When the exchange rate will not adjust, a bigger burden of adjustment is placed on stock prices, real estate prices, and firm fundamentals. The USD/INR has become significantly more controlled from late 2022. This shapes our understanding of how future shocks will play out.

The Indian state has hindered cross border activities from the time of the second world war. A wide range of people, from economists to income tax officers, have made autarky the baseline. When capital controls started getting eased in the early 1990s, the primal fear of many was captured in the question "Inflows are fine, but what will happen if all FIIs sell off their shares on one day and run away?".

But neither Indians nor FIIs are a single monolithic group that act in unison. There are thousands of traders on the market, and in any one minute, many are selling and many are buying. So we should not see FIIs as monolithic. When bad news unfolds, whether in India or outside, stock prices or real estate prices go down. This decline of asset prices attracts buyers. It has taken years for the economics community to gradually gain confidence on these questions, to shed its fear of foreigners suddenly exiting their investments on one day.

And then, there is the exchange rate. Suppose there is net selling of Indian assets by foreigners. They obtain proceeds in rupees and take these to the currency market in order to turn them into USD. A weaker rupee is required to attract short-term capital flows, and that foreign exchange is given to the exiting foreigners. The foreigners who exit from India then suffer losses at two levels: the Indian assets are sold at adverse prices, and the price obtained on the currency market is a poor one.

What would happen if the rupee was held artificially stable, if the rupee did not budge in this time of stress? That would be giving a red carpet to the foreigners who wish to exit Indian assets. It is hard to see why the Indian state should supply such risk management services to foreigners.

Price flexibility (of share prices, bond prices, real estate prices, exchange rates) is the shock absorber in the financial system. When bad news comes along, all these prices should respond. The floating exchange rate converts pro-cyclical capital flows into a counter-cyclical lever that stabilises the economy. Rupee depreciation in bad times improves Indian export competitiveness and increases the business volume for exporting firms. Imports become more expensive, which supports firms who face import competition. The prices of globalised products go up with a depreciated exchange rate, which improves business conditions for firms who make them. The exchange rate is the most important price in the price system, and the floating exchange rate is the foundation of a more stable economy.

All these ideas work in reverse when we do not have a floating exchange rate, when the Indian state prevents news from reshaping the exchange rate every day. When faced with bad news, the real economy does not get supported by improved performance of the firms involved in tradeables. When faced with bad news, the stable exchange rate works as a red carpet, and foreign investors get better terms when selling securities or real estate in order to exit. This, in turn, puts a greater burden of adjustment upon the financial market prices that are not controlled by the government, such as real estate or securities, which see bigger falls.

As the graph above shows, in early October 2022, the USD/INR got to Rs.82.8 and has since moved little. We are in a new period of a largely fixed USD/INR exchange rate. This was an important change in the exchange rate regime. We are only able to see this in hindsight. At the time, there was no public announcement of the decision or its rationale. It is not known whether the monetary policy committee was briefed about it.

No economy can have all three: (a) a domestically focused monetary policy (i.e. an inflation target), (b) control of the exchange rate, and (c) an open capital account. Trying to bring these three together generates a macroeconomic indigestion that is delicately termed `the impossible trinity problem'. A variety of policy moves of the last 20 months, such as imposing a hedging-only requirement for exchange traded derivatives (early 2024) or restrictions on LRS (August 2022 and July 2023), can be interpreted as tactical moves located in the strategic indigestion.

The idea that the Indian economy lost a shock absorber helps us understand the last 20 months. The strong dollar of this period might have normally gone with some INR depreciation, which would have helped the tradeables and export sectors of the economy. The exchange rate as a shock absorber helps across the full array of domestic and international shocks. As an example, perhaps the difficulties of transportation through the Red Sea could have generated a currency depreciation under a floating exchange rate, which was not allowed to happen. Exports grew dramatically in the post-pandemic period, but stopped growing in 2022. There is a flat patch at about 55 billion dollars a month (for non-oil non-gold exports of goods and services) from 2022 onwards. Perhaps a factor that shaped this was the change in the exchange rate regime. The difficulties in the economy today may be an `internal depreciation' playing out.

Election results have sometimes given large asset price movements. For example, when INC won in 2004 there was a large drop in stock prices and when INC won in 2009 there was a large increase. To the extent that the exchange rate is held constant in such episodes, the volatility of stock prices is exacerbated. A flexible and resilient economy is one in which there are many shock absorbers, where bad news gives a drop in the rupee and in stock prices and good news does the reverse.

Back up to Ajay Shah's 2024 media page

Back up to Ajay Shah's home page